Microsoft is unique among the big cloud players in that enables enterprises to use the same technologies in their own data center and in the Azure public cloud, said Scott Guthrie, Microsoft's Executive VP of Cloud + Enterprise, speaking at the company's Build 2016 event in San Francisco last week. The Microsoft Cloud is progressing quickly from bulk applications to advanced services, such as IoT, Microservices, Media Streaming, High Performance Compute, Data + Analytics, and Cognitive Services.

Here are some highlight on the progress of Azure:

- Azure infrastructure encompasses Compute, Storage, Networking, and Security.

- There are now 30 Azure regions around the world, which is more than AWS and Google Cloud combined. Applications run closer geographically to many users.

- In one of its US East regions, Microsoft is currently building a data center campus that is more than a mile in length.

- The Azure cloud now encompasses more than a million servers.

- The 3 main reasons customers give for adopting Azure are Choice/Flexibility, Enterprise-ready, and Productivity.

- Popular tools supported by Azure include Puppet, Chef, Ansible, WordPress, Drupal, python, Ruby, SQL, hortonworks, mongoDB, Windows Server, Red Hat, Linux, Docker, etc.

- Microsoft has tens of thousands of support professionals.

- Azure is the only global public cloud vendor with a license to operate in China.

- 85% of Fortune 500 use the Microsoft cloud

- Azure introduced hundreds of new features and services over the past 12 months. Pace of innovation continues to accelerate.

- There are over 1.4 million SQL databases currently running in Azure.

- Azure IoT is now processing 2 trillion messages per week.

- Microsoft has acquired Xamarin for mobile app testing in the cloud. Xamarin is now available at no extra charge to every Visual Studio customer.

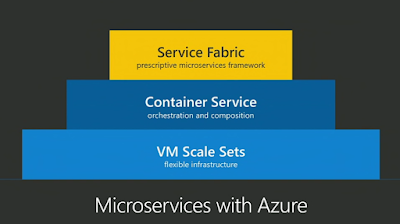

- Azure Fabric Service is now commercially available. It is a prescriptive microservice platform. It can deploy as a runtime on Azure, Azure Stack, VMware, OpenStack and AWS.

- Azure Container Service is now providing deep integration with Mesos, Swarm, Docker and other container technologies on both Linux and Windows Server.

- DocumentDB, which is a managed NoSQL database, now scales to 100s of Terabytes.

Scott Guthrie's keynote is online.

https://channel9.msdn.com/Events/Build/2016/KEY02