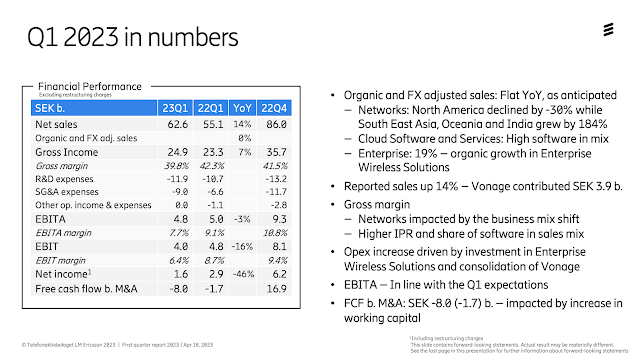

Ericsson reported flat organic sales in Q1 of SEK 62.6 billion (approximately US$6.05 billion), as sales for its Networks business unit declined by 2% driven by lower operator capex and inventory optimization among multiple customers. The decline was offset by growth in other business segments, including a 19% organic growth in Enterprise. EBITA excluding restructuring charges was SEK 4.8 (5.0) b.

Some highlights from the prepared remarks of Ericsson CEO Börje Ekholm:

"As expected, customers in early 5G markets have slowed the deployment pace somewhat. Our effect on sales is bigger as some customers have also lowered the elevated inventory levels built up in a tight supply environment. We expect this inventory adjustment to be mostly completed during Q2 but may spill into Q3. Significant growth from large roll-out projects did not fully offset the sales impact from early 5G markets. As expected, the increased share of large roll-out projects pressured the gross margin in Networks, however it positions us well for future growth. In Cloud Software and Services, we continued to execute on our turnaround strategy and reduced our loss slightly more than plan. With this progress, we are on track to reaching the important milestone of break-even in 2023."

"Following the strong cash flow in Q4, the first quarter cash flow was negative. Compared to last year working capital grew related to the changed business mix with the two components: increased customer financing for large roll-out projects in new 5G markets and reduced trade payables. As usual, Q1 cash flow was seasonally impacted by pay-out of accrued employee-related expenses."

"Cost efficiency is crucial for our long-term competitiveness. We have accelerated our cost-out execution and have identified additional savings opportunities of SEK 2 b. and now plan to reduce cost run rate by SEK 11 b. by year-end. Our early estimate, given the increased scope and more costly programs in Europe, indicates that restructuring charges may amount to around SEK 7 b. for the full year, of which more than half is likely to be booked in Q2. For 2024, we expect restructuring charges to normalize to about 0.5% of sales."

"We continue to see a choppy environment during 2023 with poor visibility. In Q2, we expect operators to remain cautious with capex investments and continue to adjust inventories. We expect this dynamic to largely be offset by growth from large roll-out projects which, as noted earlier, will be dilutive to gross margin in the short term. In the Enterprise segment, we remain confident of the long-term growth trajectory, and we expect the slower growth we saw in Q1, caused by the slower global economy, to continue in Q2. For Q2, we expect Group EBITA[2] margin to reach mid-single-digit level. We expect a gradual recovery in the second half of 2023, primarily as we expect the inventory adjustments to be completed and our cost reduction activities to start flowing through the P&L. Long-term, previous experience tells us that when operators are seeing underlying traffic growth, this leads to investments in networks in order to avoid deteriorating quality."

https://www.ericsson.com/en/press-releases/2023/4/ericsson-reports-first-quarter-results-2023