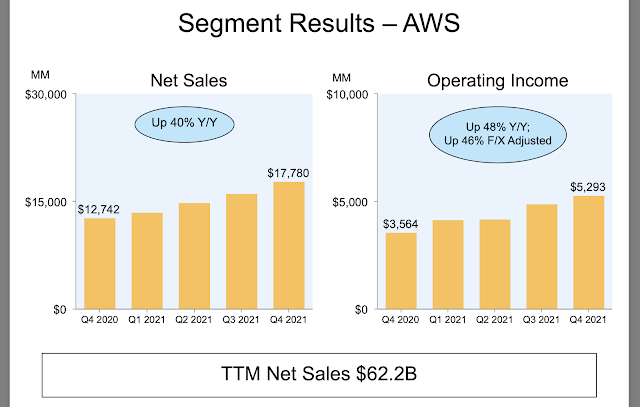

AWS net revenue for Q4 2021 reached $17.780 billion, up from $12.742 billion a year earlier. Operating income for the quarter reached $5.293 billion. For full year 2021, AWS net revenue amounted to $62.202 billion, with operating income of $18.532 billion. The company said AWS is now on a $71 billion per year revenue run rate.

During Q4, AWS continued to expand its infrastructure footprint, opening the AWS Asia Pacific (Jakarta) Region and announcing plans to launch the AWS Canada West (Calgary) Region in late 2023 or early 2024. Newly released AWS economic impact studies estimate that the AWS Asia Pacific (Jakarta) Region will create 24,700 direct and indirect jobs through a planned investment of $5 billion (IDR$71 trillion) in Indonesia over the next 15 years, and AWS will invest over $17 billion (CA$21 billion) in Canada by 2037 on the construction and operation of its two Canadian infrastructure Regions.

Globally, AWS has 84 Availability Zones across 26 geographic Regions, with announced plans to launch 24 more Availability Zones and eight more AWS Regions.