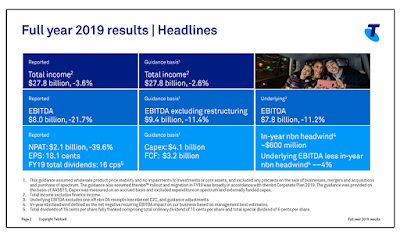

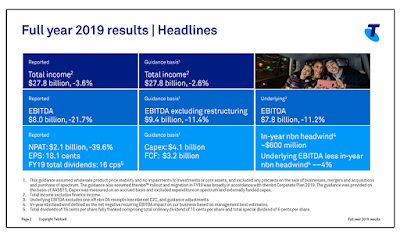

Citing negative headwinds from nbn, Telstra last week reported total FY 2019 income of A$27.8 billion, down 3.6 percent year over year. EBITDA decreased by 21.7 percent to $8.0 billion.

Regarding the impact of the nbn, Telstra absorbed around $600 million of negative recurring EBITDA headwind in the period. Underlying EBITDA decreased approximately 4 percent excluding the in-year nbn headwind.

To date, Telstra estimates the nbn has adversely impacted EBITDA by approximately $1.7 billion since FY16, and estimates it is around 50 percent of the way through the recurring financial impact of the nbn.

Telstra CEO Andrew Penn said the company is fully committed to its T22 strategy one year in and that it is making strong progress on its implementation.

“FY19 has been a pivotal year for Telstra. Notwithstanding the intense competitive environment and the challenging structural dynamics of our industry, it is a year in which I believe we can start to see the turning point in the fortunes of the company from the changes we have embraced,” Mr Penn said. “We completed our strategic investment program announced in 2016 to digitise our business and create the networks for the future, delivering over $500 million of EBITDA benefits. We passed the halfway mark of customers migrating onto the nbn network. We launched 5G, the next generation of telco technology and the platform for future growth for us and our customers. And at the start of the year we commenced our T22 strategy, where we have made very significant progress."

Telstra said it has removed $456 million in underlying costs in the year.

"This means we have achieved $1.17 billion in reductions since FY16 and we are on track to achieve our $2.5 billion net cost reduction target by FY22," Mr Penn said. “Our cost out drivers have included simplification and digitization and this has led to reductions in direct and indirect labour costs as well as non-labour related costs. Examples include 900,000 fewer truck rolls over the year enabling us to reduce our fleet vehicles by 14 percent, and we have also reduced our property footprint by 8 percent."

Some highlights:

- Telstra Consumer and Small Business - income decreased by 1.6 percent to $14,271 million, largely impacted by a 6.3 percent decline in fixed as a result of ongoing standalone fixed voice decline. Mobile services revenue decreased by 2.3 percent as declining Average Revenue Per User (ARPU) offset customer net additions. Network Applications and Services (NAS) revenue continued to grow, increasing by 13.9 percent, primarily driven by growth in unified communications.

- Mobile broadband revenue decreased by 14.0 percent to $673 million after a decline in ARPU and reduction of 266,000 customer

services in postpaid and prepaid.

IoT revenue grew by 19.4 percent to $203 million, increasing customer services by 561,000 due to the introduction of new IoT

products

- Telstra now serves a a total of 2,605,000 nbn connections, an increase of 659,000. nbn market share is now

49 percent (excluding satellite)

- Telstra Enterprise - income increased by 0.3 percent to $8,243 million as growth in international offset a decline in domestic. Telstra Enterprise domestic income decreased by 2.1 percent as growth in NAS and mobility was offset by industry ARPU decline in Data & IP and ongoing decline in ISDN. Telstra Enterprise international income grew by 9.0 percent mainly due to growth in higher-margin Data & IP and a positive impact from the depreciation of the Australian dollar (AUD).

- Networks and IT - responsible for the overall planning, design, engineering architecture and construction of Telstra networks, technology and information technology solutions. It primarily supports the revenue-generating activities of other segments. Networks and IT income decreased by 6.7 percent to $70 million.

- Telstra InfraCo - income excluding internal access charges decreased by 6.3 percent to $3,057 million due to expected declines from Telstra Wholesale fixed legacy and nbn commercial works, partly offset by increased recurring nbn DA receipts. Including internal access charges, income increased by 51.6 per cent to $4,948 million. Internal access charges were recognised from 1 July 2018 following the establishment of Telstra InfraCo as a standalone business unit, therefore there were no access charges in FY18.

- Telstra InfraCo is now fully operational as a standalone infrastructure business unit within Telstra. Telstra InfraCo controls assets with a book value of around $11 billion and is responsible for key network assets including data centres and exchanges, most of the fibre network, the copper and hybrid fibre coaxial networks, international subsea cables, poles, ducts and pipes.

In May, the U.S. Department of Commerce issued a 90-day, temporary general license allowing U.S. vendors to continue delivering products and services to Huawei Technologies and its affiliates. This first Temporary General License runs from May 20, 2019 through August 19, 2019.

In May, the U.S. Department of Commerce issued a 90-day, temporary general license allowing U.S. vendors to continue delivering products and services to Huawei Technologies and its affiliates. This first Temporary General License runs from May 20, 2019 through August 19, 2019. In May, the U.S. Department of Commerce issued a 90-day, temporary general license allowing U.S. vendors to continue delivering products and services to Huawei Technologies and its affiliates. This first Temporary General License runs from May 20, 2019 through August 19, 2019.

In May, the U.S. Department of Commerce issued a 90-day, temporary general license allowing U.S. vendors to continue delivering products and services to Huawei Technologies and its affiliates. This first Temporary General License runs from May 20, 2019 through August 19, 2019.