Cogent Communications completed its previously announced acquisition of T-Mobile's Wireline Business, which is the legacy Sprint U.S. long-haul network. The deal greatly expands Cogent's network footprint and enables it enter the U.S. market for dark fiber and wavelength services.

Cogent paid $1 as the purchase price, subject to customary adjustments for net debt and net working capital. In addition, Cogent will provide T-Mobile with IP transit services in return for $700 million in contractual monthly payments over 54 months; $350 million will be paid in the first year of the agreement.

Integration of Cogent’s network with the legacy Sprint Wireline network will substantially expand Cogent’s footprint, as well as adding ownership of 47 new facilities, aggregating to over 1,000,000 square feet.

Cogent also said that it plans to migrate these acquired network assets to its more efficient architecture, supporting IP over DWDM for greater wavelength count and throughput per wavelength. Consolidated routing infrastructure will facilitate higher port densities.

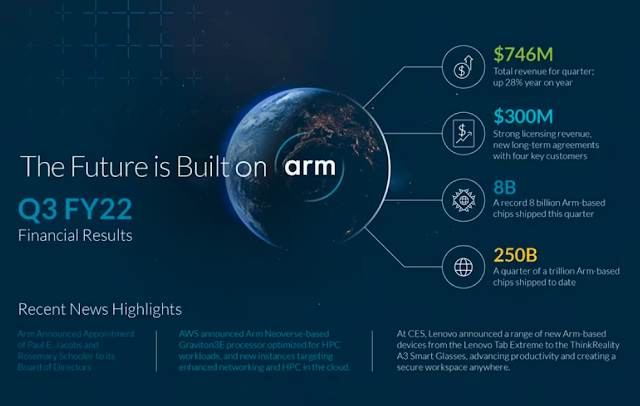

Cogent expects its revenue base will be approximately $1.1 billion, or 180% of Cogent’s current $600 million run rate. The multi- year revenue growth target for Cogent post-closing will be 5-7% annually, with targeted aggregate revenue of over $1.5 billion by 2028.