Ericsson completed its previously-announced acquisition of Vonage Holdings Corp.

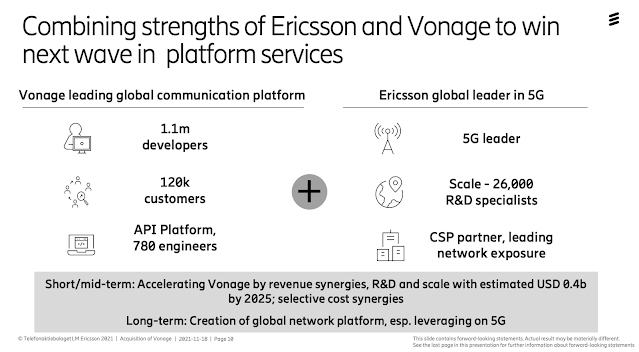

The deal provides Ericsson with a platform for offering a full suite of communications solutions including, Communications Platform as a Service (CPaaS), UCaaS and CCaaS.

Ericsson said it aims to transform the way advanced 5G network capabilities are exposed, consumed and paid for. This will provide the global developer community, including Vonage’s more than one million registered developers, with easy access to 4G and 5G network capabilities via open Application Program Interfaces (APIs).

For communications service providers (CSPs), global network APIs - such as location and quality of service APIs - provide new opportunities to expand their profit pools to monetize 5G network capabilities. For Ericsson, global APIs provide a new material growth opportunity. The existing market for communications APIs – such as video, voice and SMS – is currently growing at 30 percent annually and projected to reach USD 22 billion by 2025.

Ericsson intends to increase R&D investments and offer these solutions to CSPs.

Börje Ekholm, President and CEO, says: “We are excited to welcome Vonage as part of Ericsson. With Vonage’s suite of communications solutions – UCaaS, CCaaS and Communications APIs – Ericsson will further expand its offerings into the enterprise space. In the future, network capabilities will be consumed and paid for through open network APIs, creating the opportunity for unparalleled innovation. We have already launched the first network API, Dynamic End-user Boost, based on existing 4G infrastructure. With Vonage, we will now develop and commercialize these new APIs. We are already seeing great progress with frontrunner CSPs, and we aim to launch the first 5G network APIs in the coming year. We will continue to create new, enhanced applications and services for enterprises, while driving continued innovation on Vonage’s UCaaS and CCaaS applications, helping businesses create new digital experiences for better communications, connections and engagement.

Rory Read, Vonage CEO, says: “Vonage was born out of innovation and is today a global leader in business cloud communications. This partnership will strengthen our offerings to businesses across the globe by leveraging Ericsson’s leadership in 5G, global market presence and strong R&D capabilities. With the demand for UCaaS, CCaaS and Communications APIs growing rapidly, the combined expertise, talent and innovation is good news for our customers and partners.”

Some additional notes:

- Ericsson paid for the acquisition with cash on hand.

- The transaction is expected to be accretive to Ericsson’s EPS (excluding non-cash amortization impacts) and free cash flow before Mergers & Acquisitions (M&As) from 2024 onwards.

- Vonage will become a separate business area within the Ericsson Group - called Business Area Global Communications Platform (BGCP). Rory Read, current CEO of Vonage, is appointed Senior Vice President and Head of Business Area Global Communications Platform and a member of Ericsson’s Executive Team.

- Vonage will continue to operate under its existing name and brand being part of the Ericsson Group.

https://www.ericsson.com/en/press-releases/2022/7/ericsson-completes-acquisition-of-vonage

Ericsson to acquire Vonage for its cloud communications platform

Ericsson agreed to acquire Vonage, one of the earliest developers of a commercial VoIP service, for US$6.2 billion in cash.

Vonage traces its roots to 1998 when Jeff Pulver established Min-X.com as a VoIP exchange. In 2001, the company changed its name to Vonage and launched a commercial VoIP services aimed at consumers. Vonage went public in 2006. Vonage is headquartered in Holmdel, New Jersey and has 2,200 employees throughout the United States, EMEA and APAC.

Currently, the cloud-based Vonage Communications Platform (VCP) serves over 120,000 customers and more than one million registered developers globally. The API platform within VCP allows developers to embed high quality communications - including messaging, voice and video - into applications and products, without back-end infrastructure or interfaces. Vonage also provides Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) solutions as part of the Vonage Communications Platform.

Sales were US$1.4 billion in the 12-month period to 30 September 2021, and over the same period, Vonage delivered an adjusted EBITDA margin of 14% and free cash flow of US$109 million.

VCP accounts for approximately 80% of Vonage’s current revenues and delivered revenue growth in excess of 20% in the three-year period to 2020, with adjusted EBITDA margins moving from -19% in 2018 to break-even in the 12-month period to 30 September 2021. Vonage’s management team projects annual growth of over 20% for VCP in the coming years.

Ericsson completes Cradlepoint acquisition