F5 Networks agreed to acquire Volterra, a start-up developing a universal edge-as-a-service platform, for approximately $440 million in cash and approximately $60 million in deferred consideration and assumed unvested incentive compensation to founders and employees.

F5 said the addition of Volterra will give it an edge platform built for enterprises and service providers that will be security-first and app-driven with unlimited scale.

Volterra, which is based in Santa Clara, California, offers a distributed cloud service for deploying and managing applications at the edge. The cloud-native environment can be deployed across multiple public clouds and edge sites.

“Current edge solutions are simply inadequate for today’s enterprise customers. It’s time to break out of closed edge systems that only perpetuate the pain of building, running, and securing apps,” said François Locoh-Donou, President and CEO, F5. “With Volterra, we advance our Adaptive Applications vision with an Edge 2.0 platform that solves the complex multi-cloud reality enterprise customers confront. Our platform will create a SaaS solution that solves our customers’ biggest pain points. The success of F5’s software transformation has put us in a position to deliver on the potential of Edge 2.0 and redefine our competitive position.”

“I am excited to work closely alongside François and the F5 team to help pioneer the evolution of the edge to deliver more adaptive, dynamic application experiences for all of our customers,” said Ankur Singla, Founder and CEO, Volterra. “With our platform, we will extend F5’s application security leadership to the edge, thereby expanding our combined reach in the fastest growing segment of F5’s $28 billion 2023 total addressable market.”

In connection with the transaction, F5 raised its Horizon 2 (fiscal years 2021 and 2022) and long-term revenue outlook, and reiterated its Horizon 2 operating targets, including its commitment to achieving double-digit non-GAAP earnings per share growth. The company also reiterated its commitment to return $1 billion of capital over the next two years, including the initiation of a $500 million accelerated share repurchase in fiscal year 2021.

In addition, F5 released a preview of its first quarter fiscal year 2021 financial results stating it expects GAAP and non-GAAP revenue in a range of $623 to $626 million, driven in part, by approximately 68% GAAP, and 70% non-GAAP, software revenue growth.

- Volterra is headed by Ankur Singla, Founder & CEO, who previously was the founder and CEO of Contrail Systems, a pioneer in telco NFV and SDN technologies that was acquired by Juniper Networks in 2012. Prior to Contrail, Ankur was the CTO and VP Engineering at Aruba Networks, a global leader in wireless solutions.

Volterra unveils distributed cloud platform for apps

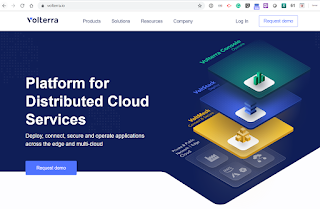

Volterra, a start-up based in Santa Clara, California, emerged from stealth to unveil its distributed cloud platform for deploying and managing applications. The SaaS-based offering integrates a broad range of services that have normally been siloed across many point products and network or cloud providers.

The cloud-native environment can be deployed across multiple public clouds and edge sites. Key capabilities include:

- Fleet-wide management of distributed applications and data across heterogeneous infrastructure

- Globally distributed control plane with Kubernetes APIs for application orchestration and multi-layer security for workloads and data

- Comprehensive compute, storage, networking and security for distributed edge locations

- Secure, high-performance global connectivity across edge sites, private clouds and multi-cloud

- VoltStack deploys and manages distributed applications across multiple clouds or edge sites using industry standard Kubernetes APIs

- VoltMesh delivers high performance networking and zero-trust security between multiple clouds and edge sites

- Volterra Console is a management console for deploying and operating distributed applications at a global scale with centralized control and observability