The Consortium for Onboard Optics (COBO) recently formed a working group to address Multi-mode Waveguide Interconnect System (MWIS) as an alternative to copper traces in printed circuit boards. In this video, Joshua Kihong Kim, Principal Engineer, Photonic Signal Integrity, Hirose, discusses the latest developments.

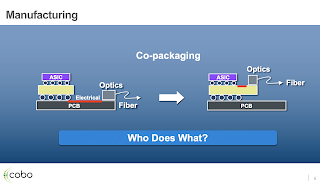

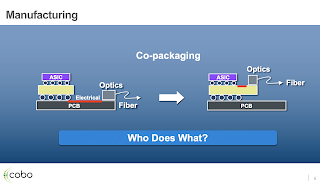

The Consortium for On-Board Optics (COBO) has established a new Multi-Mode Waveguide Interconnect System (MWIS) Working Group to focus specifically on the replacement of copper traces with multi-mode waveguides and adding an extra thin interface for Electrical/Optical and Optical/Electrical conversion within close proximity to the electrical component.

"I am very pleased to have kicked off the new Multimode Waveguide Interconnect System (MWIS) Working Group. Although embedded optical waveguides in printed circuit boards have been researched for decades, now is the time for the industry to work together to address the imminent bandwidth and power issues associated with copper interfaces," said Joshua Kihong Kim, Principal Engineer at Hirose Electric and COBO MWIS Working Group Chair. "In the development of on-board optical systems, this is one of the missing pieces of the puzzle, and COBO is stepping up to develop specifications to enable an industry eco-system."

"The growing diversity of optical applications within the Data Center, including machine learning and resource disaggregation, are driving an increased need to enhance high-speed board level interconnect systems with optical waveguide technology. COBO members recognize it is critical for companies to collaborate and provide guidance and specifications for design advancement," said Brad Booth, President at COBO and Principal Engineer, Azure Hardware Architecture at Microsoft. "We welcome interested parties to contact us if they would like understand more about our new MWIS Working Group."

http://onboardoptics.org/