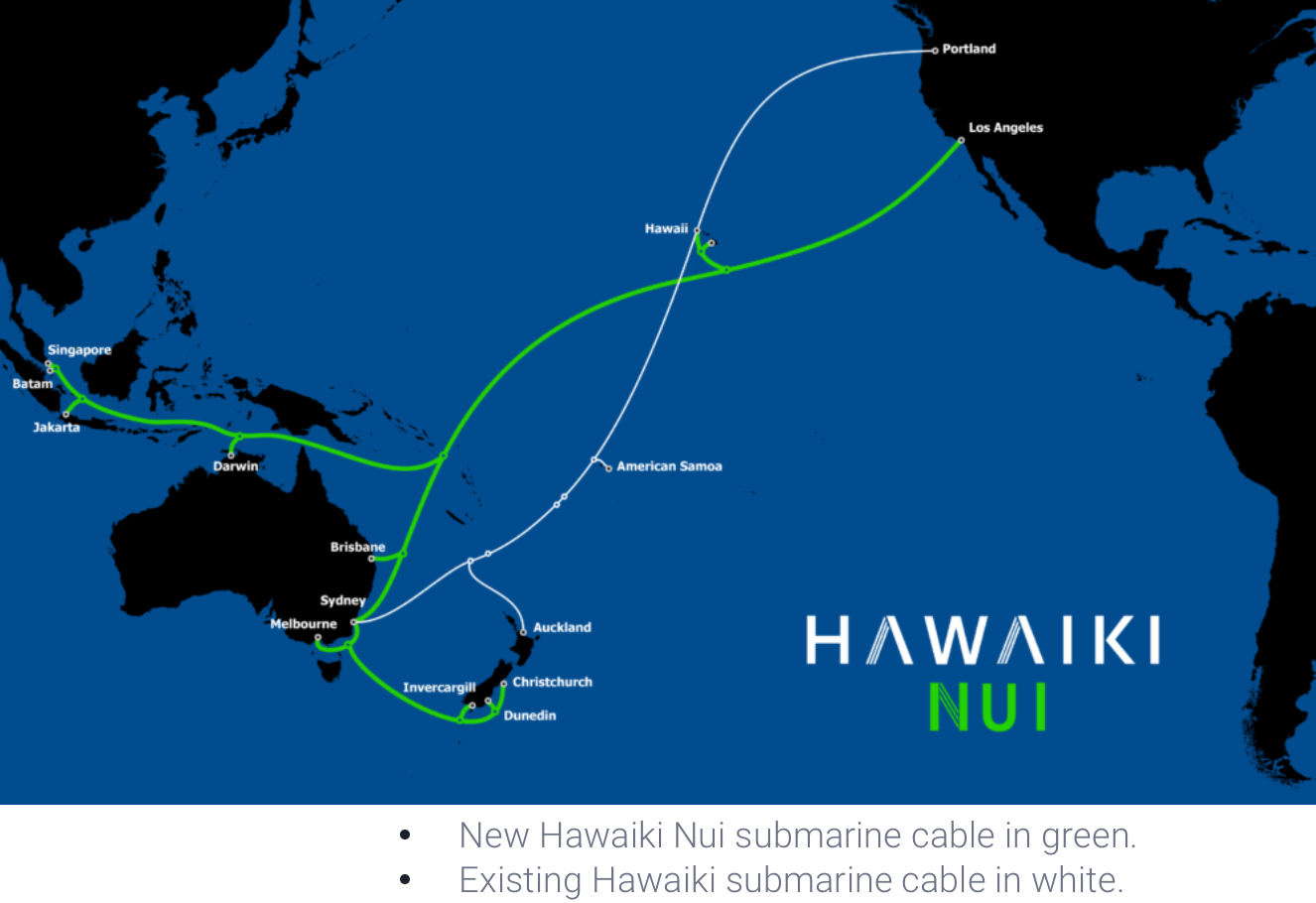

Commercial 400GbE services on the Hawaiki Transpacific Cable, which is owned by BW Digital. The 13,540km Hawaiki cable connects Australia, New Zealand, American Samoa, Hawaii, and the U.S. West Coast.

The new capability is powered by Ciena's GeoMesh Extreme submarine network solution. It is supported by the Waveserver 5 compact interconnect platform, powered by WaveLogic 5 Extreme programmable 800G technology, running over the 6500 Packet-Optical Platform Submarine Line Terminal Equipment (SLTE).

Validation was performed using EXFO’s multi-technology 400G Test Set, which is an Open Transceiver System and Intelligent Pluggable Optics test application. Results demonstrated smooth traffic and no latency impact across the Sydney to Hillsboro segment. BW Digital was supported by WWG Comtest, the EXFO partner in New Zealand, for the loan and technical support on the EXFO Test Set.

The Hawaiki cable has previously tested and achieved 500Gbps channel wavelengths.

“Our recent upgrades with Ciena’s GeoMesh Extreme put us in good stead to respond to ever-growing market requirements for international connectivity,” said Ludovic Hutier, Chief Executive Officer, BW Digital, which owns the Hawaiki cables. “Ciena and BW Digital have a long-standing relationship, and this is but one of many connectivity highlights that we hope to continue to bring to our customers.”

“Cable operators globally are always looking for ways to upgrade their cables to be faster, smarter, safer, and more open. Our GeoMesh Extreme is providing BW Digital an end-to-end network architecture, enabling the Hawaiki cable to deliver 400GbE services on its network, which is crucial in meeting the needs of today’s digital consumers, enterprises, and content providers,” said Thomas Soerensen, Vice President, Global Submarine Solutions, Ciena.