The future of data center network architecture was the key theme at last week's Co-Packaged and Pluggable Optics Industry Summit, an invite-only event presented by Optica and the Consortium for On-Board Optics (COBO) will host the at the DuPont Silicon Valley Technology and Innovation Center.

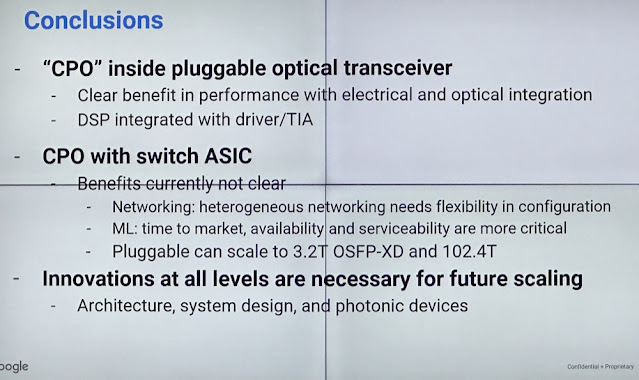

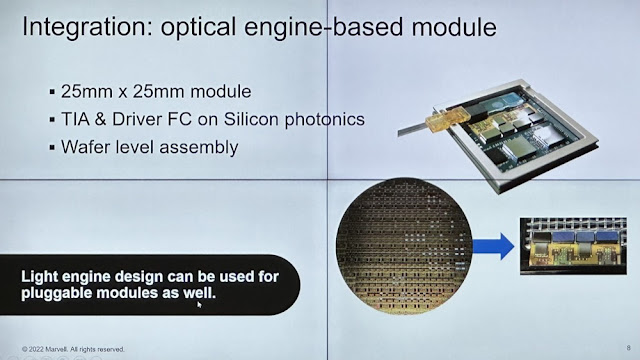

Google: The pluggable design factor for hyperscale data center switches is working well and there is a roadmap to scale for several more generations, said Hong Liu, Google Fellow. Her presentation cited the potential of pluggable interfaces as high as 3.2T OSFP-XD and future 102.4T switch designs. Rather than CPO interfaces on switching silicon, future data center networks could scale using Optical Circuit Switching using MEMS mirror arrays. CPO inside pluggable optical transceiver is beneficial, such as integrating DSPs with TIAs.

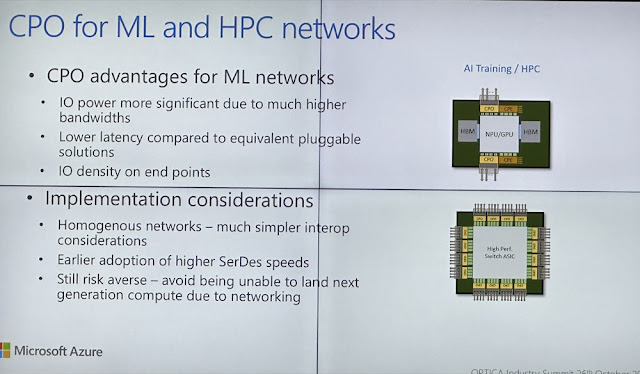

Speaking on behalf of Microsoft, Moray McLauren made the case that package-level optical integration (CPO) is needed to (1) address the rising power requirements in data centers ("network power tax is increasing, reducing end user revenue power"), (2) extend radix reach (3) lower component costs (4) drive AI/ML and HPC applications

Meta's Katharine Schmidtke, Director of ASIC and Custom Silicon Sourcing, also presented the case for optical interconnects in AI/ML hardware. As compute fabrics adopt a cluster architecture, the network fabric has to scale. Compared with existing optical modules, CPO promises to significantly reduce the power demands of the new computing clusters.

Power savings in the network can be achieved in other ways, said John Shalf, Lawrence Berkeley National Laboratory. Think wide and slow! This applies to innovations in (1) in-package integration, (2) DWDM using Silicon Photonics (ring resonators) (3) new comb laser sources capable of generating 100s of frequencies

NVIDIA is moving forward with its own NVLink over optics approach to solve the scaling problem, said Craig Thomson.

Jeff Maki, Distinguished Engineer at Juniper Networks and Board Member of COBO, presented a taxonomy of 400G and 800G interfaces.

Arista's Andy Bechtolscheim presented the strongest case that pluggables are the best solution for Ethernet data center switching and that CPO switches fall short in time-to-market, standardization, break out connectors and a host of other issues. Potential applications for CPO might include copackaging with DSPs inside pluggable modules at 224G and non-Ethernet uses cases such as AI chips.

Pluggable optics remains a feasible and dominant use case for the next generation of switching said Cisco's Anthony Torza.

It is all about system level power, said Infinera's Dave Welch. Through its vertical integration, Infinera already offers a 400G ZR+ pluggable module with a 1600km range. For intra data center range, innovations such as the microLED technology developed by Avicena promise very significant power improvements with integration in CMOS.