Vantage Data Centers highlighed rapid growth of its portfolio of data centers in 2022 and plans for new facilities.

North American Expansion: Vantage opened seven new data centers across its inaugural region of North America while continuing its aggressive expansion to keep pace with customer requirements.

Canada: With a CAD$900M investment in Canadian operations, Vantage began development of a third Montreal campus while expanding existing campuses in Montreal and Quebec City. Upon completion, Vantage’s four Canadian campuses will total 143MW.

Phoenix: Vantage broke ground on phase two of its growing Phoenix campus. Once fully developed, the mega campus will offer hyperscalers and large cloud providers 160MW of IT capacity across three facilities.

New Facilities: Vantage opened new data centers in many of its North American markets, including Virginia, Arizona, Washington, California, Montreal and Quebec City.

EMEA Expansion: Vantage opened its first campuses in South Africa and Poland while launching new investments in solar and wind power.

South Africa: Vantage opened its first African data center campus in Johannesburg, South Africa, offering 16MW of IT capacity and announced the development of a second Johannesburg campus that will consist of 20MW of IT capacity.

Poland: The company opened its first data center campus in Poland. Once fully developed, the two-data center development will offer 48MW of IT capacity.

Germany: Vantage announced four new data center openings in Frankfurt and Berlin along with a new business office in Raunheim.

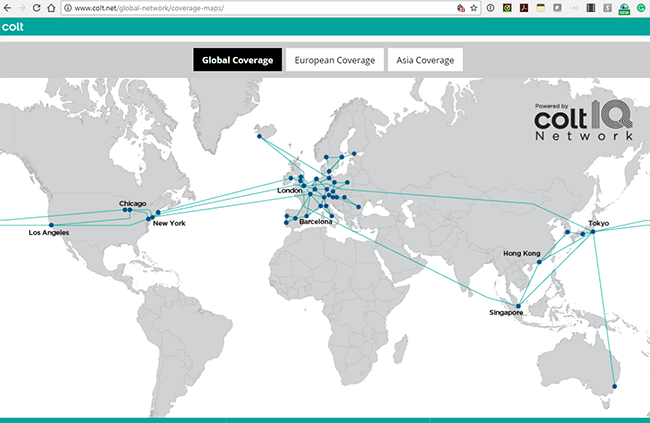

APAC Expansion: Since entering the region just over one year ago, Vantage has made significant strides to meet rising demand for digital infrastructure in APAC.

Cyberjaya: Vantage announced the delivery of a second data center (KUL12) on its Cyberjaya campus in Kuala Lumpur, Malaysia. The company concurrently announced plans to continue expanding the campus with a third facility (KUL13), which will open its doors in the first half of 2023.

Hong Kong: In November, Vantage announced the opening of a new Hong Kong office, serving as the regional hub to house engineering, construction, sales, finance and accounting, and leadership functions to support the company’s business across APAC.

The expansion is supported by more than USD$3 billion of debt and equity financing raised throughout the year, including USD$368 million in green loans to advance sustainable developments in Quebec City, Canada, and Northern Virginia.

“Vantage experienced explosive growth over the past year as we continued to remain hyper focused on meeting customer demand for sustainable digital infrastructure around the world,” said Sureel Choksi, president and CEO of Vantage Data Centers. “We appreciate the trust that our customers placed in us, as well as the confidence that our investors continue to have in our ability to execute.”

“The team at Vantage has built a world-class portfolio of hyperscale data centers, supporting the continued growth of the largest global technology companies as they scale their businesses to meet global market demand,” said Marc Ganzi, president and CEO of DigitalBridge. “Vantage is an industry innovator, and with the support of our team at DigitalBridge, will continue to grow and deliver reliability, efficiency and sustainability for the benefit of their hyperscale customers.”