Lumentum agreed to acquire NeoPhotonics for $16.00 per share in cash, representing a total equity value of approximately $918 million and a premium of approximately 39% to NeoPhotonics' closing stock price on November 3, 2021.

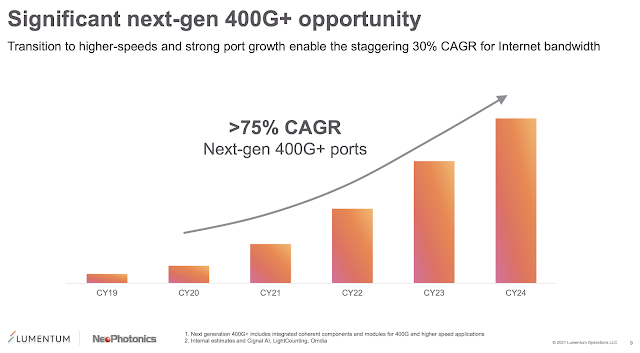

The companies cited significant next-gen 400G+ opportunities as a leading driver for the merger.

NeoPhotonics, which was founded in 1996 and is based in San Jose, is a leading supplier of tunable lasers and optoelectronic components, including devices manufactured in its own Indium Phosphide fabs and combined with electronics using using Advanced Hybrid Photonic Integration techniques. The product portfolio includes coherent components and tunable lasers, coherent transceivers, wavelength management products, as well as fixed wavelength lasers and high speed driver ICs. The company has engineering and manufacturing facilities in Silicon Valley (USA), Japan and Shenzhen, China.

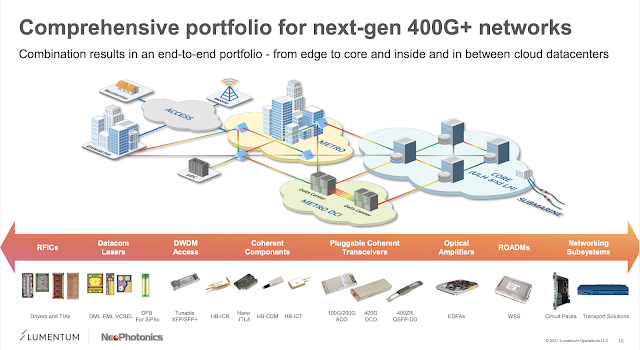

Lumentum said the acquisition strengthens its position in the more than $10 billion market for optical components used in cloud and telecom network infrastructure.

"With NeoPhotonics, we're making another important investment in better serving our customers and expanding our photonics capabilities at a time when photonics are at the forefront of favorable long-term market trends," said Alan Lowe, Lumentum President and CEO. "At the center of our strategy is a relentless focus on developing a differentiated portfolio with the most innovative products and technology in our industry so that we can help our customers compete and win in their respective markets. Adding NeoPhotonics' differentiated products and technology and innovative R&D team is consistent with this strategy and together, we will better meet the growing need for next generation optical networking solutions."

"Today's announcement is an exciting milestone for NeoPhotonics," said Tim Jenks, NeoPhotonics President, CEO, and Chairman. "The increasing global demand for our ultra-pure light tunable lasers and photonics technologies for speed over distance applications is more apparent than ever, and Lumentum is the ideal partner to serve our customers on a larger scale. Lumentum recognizes the importance of NeoPhotonics' differentiated photonic technology and products, which are well positioned for accelerated growth in the coming years. "

Lumentum intends to finance the transaction through cash from the combined company's balance sheet. Lumentum also noted that it will provide up to $50 million in term loans to NeoPhotonics to fund anticipated growth, which may require increased working capital and manufacturing capacity.

Separately, NeoPhotonics reported Q3 2021 revenue of $83.7 million, at the high end of guidance range, up 29% quarter-over-quarter and down 18% year-over-year. Gross margin was 28.4%, up from 15.2% in the prior quarter.

“With our very strong performance in the third quarter, we have returned to operating profit on a non-GAAP basis, as we forecasted one year ago. Operating income on a GAAP basis was a loss of $1.3 million, a substantial improvement over our second quarter. Our accelerated growth has been driven by products for 400G and above applications, including the initial ramp of 400ZR and related products, adding to our 400G and above suite,” said Tim Jenks, Chairman and CEO of NeoPhotonics.

Lumentum also reported net revenue of 2022 was $448.4 million for its fiscal first quarter ended October 2, 2021, with GAAP net income of $81.5 million, or $1.08 per diluted share.

"Driven by strong demand, first quarter financial results were above our guidance ranges across all metrics," said Alan Lowe, President and CEO. "Our Industrial and Consumer product lines and our Commercial Lasers segment revenues were ahead of expectations which more than offset the impact of semiconductor shortages in our Telecom and Datacom product lines."

"Looking to the second quarter, demand continues to be strong, particularly in Telecom and Datacom as well as Commercial Lasers, where we expect revenue to grow sequentially. While we are increasing our supply of semiconductors, we expect the gap between demand and supply for our products in the second quarter will be larger than it was in the first quarter, and we have incorporated this in our guidance," added Mr. Lowe.

NeoPhotonics adds tunable, high power FMCW laser

NeoPhotonics debuts CFP2-DCO module for 400G ROADMs

Lumentum intros 400G CFP2-DCO coherent modules, PAM4 DMLs with 2 km reach for 400G+

At next week's virtual Optical Fiber Communication Conference (OFC) Lumentum will introduce new 400G CFP2-DCO coherent modules, enhanced PAM4 DMLs with 2 km reach for 400G+ applications, and expanded WSS capabilities.The new high-performance 400G CFP2-DCO coherent transmission modules build on the company's existing its 200G CFP2-DCO coherent pluggable transceiver modules, enabling next-generation data center interconnects (DCI) and metro/regional...

At next week's virtual Optical Fiber Communication Conference (OFC) Lumentum will introduce new 400G CFP2-DCO coherent modules, enhanced PAM4 DMLs with 2 km reach for 400G+ applications, and expanded WSS capabilities.The new high-performance 400G CFP2-DCO coherent transmission modules build on the company's existing its 200G CFP2-DCO coherent pluggable transceiver modules, enabling next-generation data center interconnects (DCI) and metro/regional...

NeoPhotonics ships QSFP-DD and OSFP 400ZR coherent modules

NeoPhotonics: Pluggable 400G over 1500 km in a 75 GHz-spaced system

NeoPhotonics ships first coherent components for 800G and up

NeoPhotonics: cumulative shipments of 2M lasers for coherent links

Lumentum completes acquisition of Oclaro

Lumentum Showcases 100G Single Lambda PAM4 EML, 400G