SES' second-generation, software-enabled O3b mPOWER satellite system is now operational and delivering commercial services.

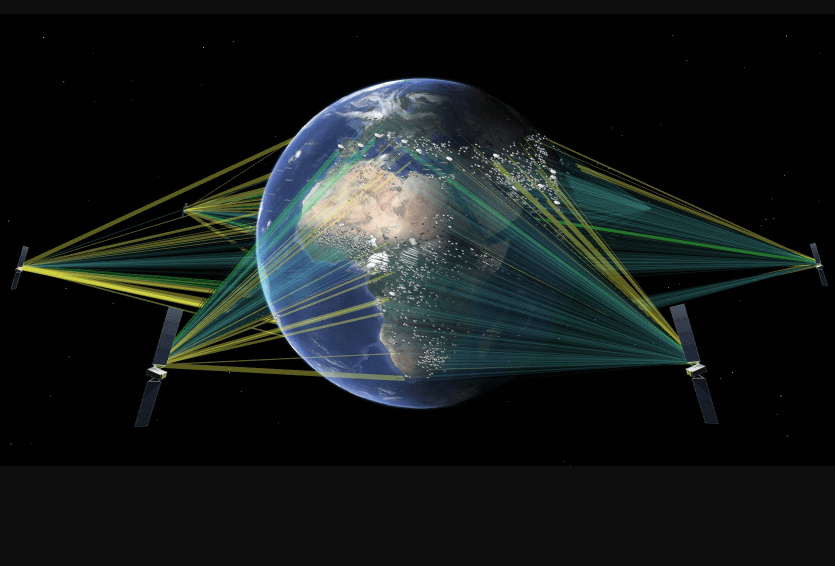

The first six O3b mPOWER satellites are operating at medium Earth orbit (MEO) or 8,000km. SES also has extensive ground infrastructure in place, enabling connectivity services ranging from tens of Mbps to multiple gigabits per second.

To date, SES has launched six out of 13 O3b mPOWER high-throughput and low-latency satellites, which together with strategically located satellite ground stations, enable SES to serve customers across multiple market segments around the world.

In combination with SES’s MEO and geostationary (GEO) networks as well as access to low Earth orbit (LEO) solutions via strategic partnerships, SES is uniquely positioned as an all-orbit solutions provider delivering an attractive combination of high data rates, low latency, service reliability, and flexibility to meet customers’ requirements anywhere.

“We are very excited that O3b mPOWER is now ready to serve our customers around the world. Over the last few years, our SES team, along with our technology partners across space and ground segments, have worked tirelessly to bring our O3b mPOWER system online. I’m proud to say that all the core infrastructure is deployed, tested and ready on a global basis,” said Adel Al-Saleh, CEO of SES. “The demand for O3b mPOWER solutions is very high, and this moment has been long-awaited by our customers. Over the coming weeks we will work with our mobility, government, enterprise and cloud customers on O3b mPOWER onboarding plans. We’re eager to empower their operations with reliable, high-performance, and secure services.”

The launch of the next two O3b mPOWER satellites is expected in late 2024.