AT&T reported Q1 revenues of $39.4 billion versus $40.5 billion in the year-ago quarter. The company cited record-low equipment sales in wireless for the revenue dip, but said it recorded its best-ever first-quarter postpaid phone churn of 0.90%

Compared with results for the first quarter of 2016, operating expenses were $32.5 billion versus $33.4 billion; operating income was $6.9 billion versus $7.1 billion; and operating income margin was 17.4% versus 17.6%.

“In a very competitive quarter, we continued to execute on our goals of driving efficiencies in our business while growing adjusted earnings per share. But just as important, the strategic moves we’ve made over the last few months to expand our wireless capacity and fortify our 5G leadership will be felt for years to come,” said Randall Stephenson, AT&T Chairman and CEO. “FirstNet gives us access to 20 megahertz of valuable, low-band spectrum and allows us to deploy our spectrum assets more efficiently as we build a high-quality, mobile broadband network for our first responders. And our planned acquisitions of Fiber Tower and Straight Path will add valuable millimeter wave spectrum assets to our 5G tool kit as we lead the way to the next generation of wireless technology.”

“In a very competitive quarter, we continued to execute on our goals of driving efficiencies in our business while growing adjusted earnings per share. But just as important, the strategic moves we’ve made over the last few months to expand our wireless capacity and fortify our 5G leadership will be felt for years to come,” said Randall Stephenson, AT&T Chairman and CEO. “FirstNet gives us access to 20 megahertz of valuable, low-band spectrum and allows us to deploy our spectrum assets more efficiently as we build a high-quality, mobile broadband network for our first responders. And our planned acquisitions of Fiber Tower and Straight Path will add valuable millimeter wave spectrum assets to our 5G tool kit as we lead the way to the next generation of wireless technology.”

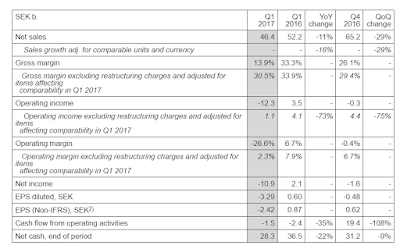

Here are some highlights from AT&T Q1 financial report:

http://www.att.com

Compared with results for the first quarter of 2016, operating expenses were $32.5 billion versus $33.4 billion; operating income was $6.9 billion versus $7.1 billion; and operating income margin was 17.4% versus 17.6%.

“In a very competitive quarter, we continued to execute on our goals of driving efficiencies in our business while growing adjusted earnings per share. But just as important, the strategic moves we’ve made over the last few months to expand our wireless capacity and fortify our 5G leadership will be felt for years to come,” said Randall Stephenson, AT&T Chairman and CEO. “FirstNet gives us access to 20 megahertz of valuable, low-band spectrum and allows us to deploy our spectrum assets more efficiently as we build a high-quality, mobile broadband network for our first responders. And our planned acquisitions of Fiber Tower and Straight Path will add valuable millimeter wave spectrum assets to our 5G tool kit as we lead the way to the next generation of wireless technology.”

“In a very competitive quarter, we continued to execute on our goals of driving efficiencies in our business while growing adjusted earnings per share. But just as important, the strategic moves we’ve made over the last few months to expand our wireless capacity and fortify our 5G leadership will be felt for years to come,” said Randall Stephenson, AT&T Chairman and CEO. “FirstNet gives us access to 20 megahertz of valuable, low-band spectrum and allows us to deploy our spectrum assets more efficiently as we build a high-quality, mobile broadband network for our first responders. And our planned acquisitions of Fiber Tower and Straight Path will add valuable millimeter wave spectrum assets to our 5G tool kit as we lead the way to the next generation of wireless technology.” Here are some highlights from AT&T Q1 financial report:

- Total revenues from Consumer Mobility customers totaled $7.7 billion, down 7.1% versus the year-earlier quarter, reflecting fewer phone sales and upgrades and lower postpaid service revenues mostly due to migrations to business plans. In the quarter, Consumer Mobility lost 353,000 total subscribers with 282,000 prepaid and 19,000 connected device net adds partially offsetting a loss of 66,000 postpaid and 588,000 reseller subscribers.

- Total first-quarter revenues from business customers were $16.8 billion, down 4.3% versus the year-earlier quarter due to declines in legacy wireline services and fewer wireless equipment upgrades. Strategic business services, the next-generation wireline services, including VPNs, Ethernet, cloud, hosting, IP conferencing, voice over IP, dedicated internet, IP broadband and security services, grew by $223 million, or 8.1%, versus the year-earlier quarter. These services represent 40% of total business wireline revenues and an annualized revenue stream of nearly $12 billion. Growth in strategic business services helped offset a decline of $743 million in legacy services in the quarter.

- At the end of the first quarter, AT&T had more than 82 million business wireless subscribers.

- AT&T Entertainment Group (including DirecTV) total revenues were $12.6 billion, generally flat versus the year-earlier quarter. The Entertainment Group had a net gain of 242,000 IP broadband subscribers in the first quarter with DSL losses of 127,000, for total broadband subscriber growth of 115,000. IP broadband subscribers at the end of the quarter totaled 13.1 million.

http://www.att.com