American Tower agreed to acquire CoreSite for $170.00 per share in cash, an enterprise value of $10.1 billion when including the assumption and/or repayment of CoreSite’s existing debt.

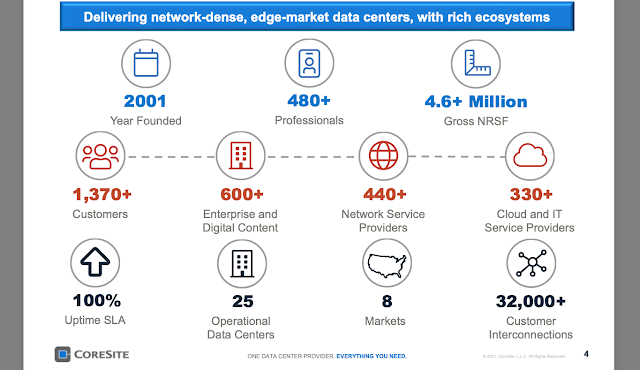

CoreSite, which as of Q3 2021 consisted of 25 data centers, 21 cloud on-ramps and over 32,000 interconnections in eight major U.S. markets, generated annualized revenue and Adjusted EBITDA of $655 million and $343 million, respectively, in Q3 2021. CoreSite has averaged double-digit annual revenue growth over the past five years.

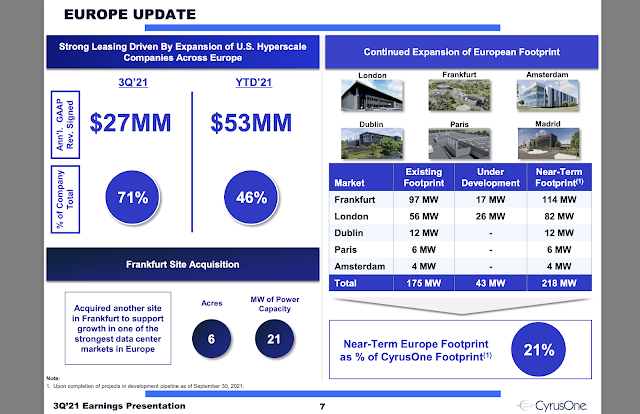

American Tower said it expects to leverage its strong financial position to further accelerate CoreSite’s attractive development pipeline in the U.S., while also evaluating the potential for international expansion in the data center space. The acquisition is also expected to be transformative for American Tower’s mobile edge compute business in advance of the proliferation of 5G low-latency applications throughout the cloud, enterprise and network ecosystems, establishing a converged communications and computing infrastructure offering with distributed points of presence across multiple edge layers.

Tom Bartlett, American Tower’s Chief Executive Officer stated, “We are in the early stages of a cloud-based, connected and globally distributed digital transformation that will evolve over the next decade and beyond. We expect the combination of our leading global distributed real estate portfolio and CoreSite’s high quality, interconnection-focused data center business to help position American Tower to lead in the 5G world. As the convergence of wireless and wireline networks accelerates and classes of communications infrastructure further align, we anticipate the emergence of attractive value creation opportunities within the digital infrastructure ecosystem. We look forward to welcoming CoreSite’s talented team to American Tower and working together to capitalize on those opportunities to drive enhanced long-term value creation for our customers and shareholders as we continue to connect billions of people across the globe.”

CoreSite’s Chief Executive Officer, Paul Szurek, stated, “We are excited to partner with American Tower to expand its communications infrastructure ecosystem and accelerate its edge computing strategy through the addition of CoreSite’s differentiated portfolio of U.S. metro data center campuses. The combined company will be ideally positioned to address the growing need for convergence between mobile network providers, cloud service providers, and other digital platforms as 5G deployments emerge and evolve. In addition, we expect the enhanced scale and further geographic reach to provide a platform for the combined company to accelerate its growth trajectory and expand into additional U.S. metro areas, as well as internationally, leveraging American Tower’s extensive presence across the globe. CoreSite’s outstanding team, interconnection platform and data center campus portfolio are a highly complementary fit with American Tower’s existing communications sites, and we believe this partnership delivers significant value to CoreSite’s stockholders and will create an exciting new chapter for our customers, employees and partners.”

American Tower intends to finance the transaction in a manner consistent with maintaining its investment grade credit rating and has obtained committed financing from J.P. Morgan.