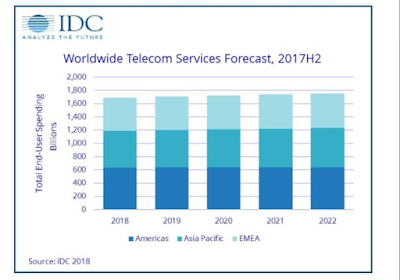

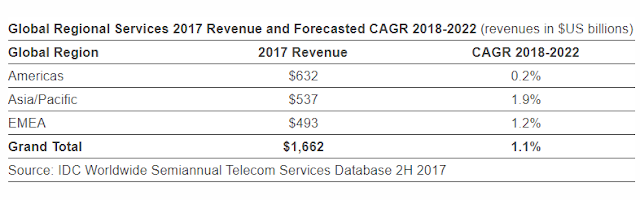

Worldwide spending on telecommunications services and pay TV services reached $1,662 billion in 2017, an increase of 1.4% year over year (in constant dollar terms), according to the International Data Corporation's (IDC) Worldwide Telecom Services Database, and will accelerate to a 1.6% growth rate in 2018, bringing worldwide spending on telecom and pay TV services to $1,689 billion. IDC is predicting the market to continue its positive growth until the end of the five-year forecast period (2018-2022), growing at a compound annual growth rate (CAGR) of 1.1%.

On a geographic basis, the Americas will remain the largest services market until the end of the forecast period in 2022. However, due to somewhat slower growth compared to other regions, its share of total worldwide spending will decline from 38% in 2017 to 36% in 2022. In contrast, Asia/Pacific will see its share increase from 32% to 34%.

"The Asia/Pacific market is growing faster than other regions due to the thirst for data services – spending on fixed data services is set to grow by 6% over the forecast period, which is significantly higher than other regions and this, coupled with mobile data growth, is driving the overall market growth," said Eric Owen, group vice president, EMEA Telecommunications & Networking at IDC.

"The global telecoms market will maintain steady growth of 2% over the forecast timeframe of 2018-2022. Communications service providers are in transition, facing a flat voice market, but steady growth in fixed and mobile data services. Fixed data services will grow by 4% due to strong demand for broadband, Ethernet, and high-speed fiber connectivity. While mobile voice revenues are declining, this sector will be sustained by strong growth in data and other services," said Courtney Munroe, group vice president, Worldwide Telecommunications Research at IDC.

On a geographic basis, the Americas will remain the largest services market until the end of the forecast period in 2022. However, due to somewhat slower growth compared to other regions, its share of total worldwide spending will decline from 38% in 2017 to 36% in 2022. In contrast, Asia/Pacific will see its share increase from 32% to 34%.

"The Asia/Pacific market is growing faster than other regions due to the thirst for data services – spending on fixed data services is set to grow by 6% over the forecast period, which is significantly higher than other regions and this, coupled with mobile data growth, is driving the overall market growth," said Eric Owen, group vice president, EMEA Telecommunications & Networking at IDC.

"The global telecoms market will maintain steady growth of 2% over the forecast timeframe of 2018-2022. Communications service providers are in transition, facing a flat voice market, but steady growth in fixed and mobile data services. Fixed data services will grow by 4% due to strong demand for broadband, Ethernet, and high-speed fiber connectivity. While mobile voice revenues are declining, this sector will be sustained by strong growth in data and other services," said Courtney Munroe, group vice president, Worldwide Telecommunications Research at IDC.