BT Group plc published the following results for the full year to 31 March 2022:

- Revenue £20.9bn, down 2%, reflecting revenue decline in Enterprise and Global offset by growth in Openreach, with Consumer flat for the year and returning to growth in Q4; adjusted revenue down 2%

- Adjusted EBITDA £7.6bn, up 2%, with revenue decline more than offset by lower costs from modernisation programmes, tight cost management, and lower indirect commissions

Philip Jansen, Chief Executive, commenting on the results, said

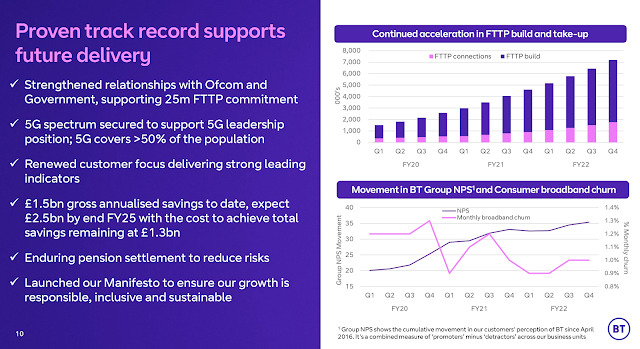

“BT Group has again delivered a strong operational performance thanks to the efforts of our colleagues across the business. Openreach continues to build like fury, having now passed 7.2m premises with 1.8m connections; a strong and growing early take-up rate of 25%. Meanwhile, our 5G network now covers more than 50% of the UK population. We have the best networks in the UK and we’re continuing to invest at an unprecedented pace to provide unrivalled connectivity for our customers. At the same time we’re seeing record customer satisfaction scores across the business.

“Our modernisation continues at pace and we are extending our cost savings target of £2bn by end FY24 to £2.5bn by end FY25. We delivered EBITDA growth of 2% this year as strong savings from our modernisation programme more than offset weaker revenues from our enterprise businesses due to well-known market challenges.

“While the economic outlook remains challenging, we’re continuing to invest for the future and I am confident that BT Group is on the right track. As a result, we are today reconfirming our FY23 outlook for revenue growth, EBITDA of at least £7.9bn and also the reinstatement of our full year FY22 dividend, as promised, at 7.7 pence per share.”

https://newsroom.bt.com/results-for-the-full-year-to-31-march-2022/