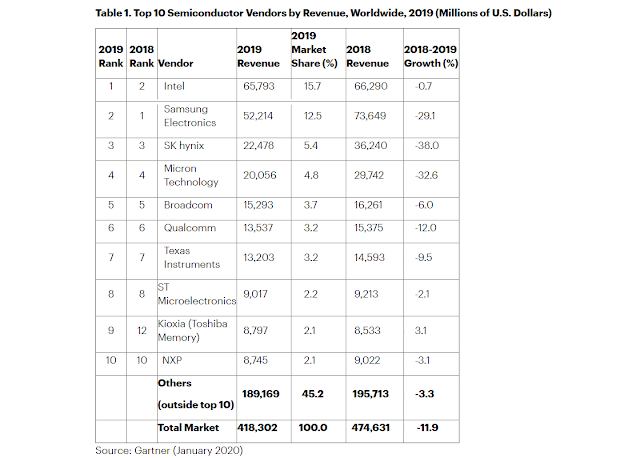

Worldwide semiconductor revenue totaled $418.3 billion in 2019, down 11.9% from 2018, according to preliminary results by Gartner, Inc. The report cites the drop in the memory market as the top reason for the decline. Sales analog products’ declined 5.4% while optoelectronics grew 2.4%.

“The memory market, which accounted for 26.7% of semiconductor sales in 2019, experienced a 31.5% decline in revenue in 2019,” said Andrew Norwood, research vice president at Gartner. “Within memory, DRAM revenue declined 37.5% due to an oversupply that started at the end of 2018 and lasted throughout 2019. The oversupply was caused by a sudden fall in demand from the hyperscale market. This revealed excessive OEM inventory levels that took the first half of the year to correct. Excessive inventory at DRAM vendors in the second half of 2019 pushed pricing lower and resulted in an average selling price (ASP) decline of 47.4% in 2019.”

“In 2020, we expect to see semiconductor market revenue increase after the high inventory clearance to drive up the chip ASP, especially in the memory sector,” said Mr. Norwood. “The U.S.-China trade war seems to be easing as we move into 2020. However, during 2019 the U.S. added several Chinese companies, including Huawei, to the Entity List restricting the sale of U.S. components. The immediate impact was to push Huawei into looking outside the U.S. for alternative silicon suppliers, with wholly owned HiSilicon at the top of the list as well as alternative suppliers based in Japan, Taiwan, South Korea and China. This will be an area to watch in 2020.”

Popular Posts

-

MEF Annual Meeting – July/August 2019, Dan Pitt, SVP, MEF, outlines MEF’s strategy for SD-WAN and how it relates to MEF's work on inte...

-

Violin Memory announced an OEM agreement with VMware, offering virtualization-in-a-box to enterprise customers. This enables companies to r...

-

Brightcove, a start-up building an open Internet TV service that would help video producers to monetize their content, will offer On2 Techno...

-

Peter Blackmore, president and CEO of ShoreTel, announced his intention to retire as soon as a successor is announced. "It has been a...

-

Astera Labs announced expanded PCIe 6.x testing capabilities in its Cloud-Scale Interop Lab to enable seamless interoperability between Arie...

-

ZEDEDA, a start-up based in San Jose, California, announced $72 million in Series C funding for its edge management and orchestration softwa...

-

Astera Labs has demonstrated end-to-end PCIe optical connectivity to provide unprecedented reach for larger, disaggregated GPU clusters. The...

-

Aviz Networks, a start-up based in San Jose, California, has added Cisco Investments to its latest funding expansion, joining existing inves...

-

Marvell introduced its Alaska P PCIe retimer product line for data center compute fabrics inside accelerated servers, general-purpose server...

-

Lumentum is extending its indium phosphide (InP) transceiver component leadership with its new 200G Lens Integrated Photodiode (LIPD) that s...

Archive

-

►

2024

(1159)

-

►

August

(121)

- Aug 21 (8)

- Aug 20 (9)

- Aug 19 (8)

- Aug 16 (8)

- Aug 15 (8)

- Aug 14 (9)

- Aug 13 (7)

- Aug 12 (2)

- Aug 11 (6)

- Aug 10 (2)

- Aug 09 (2)

- Aug 07 (8)

- Aug 06 (18)

- Aug 05 (9)

- Aug 04 (1)

- Aug 02 (8)

- Aug 01 (8)

-

►

July

(150)

- Jul 31 (10)

- Jul 30 (7)

- Jul 29 (7)

- Jul 28 (6)

- Jul 25 (8)

- Jul 24 (10)

- Jul 23 (6)

- Jul 22 (9)

- Jul 21 (5)

- Jul 20 (1)

- Jul 18 (7)

- Jul 17 (6)

- Jul 16 (8)

- Jul 15 (7)

- Jul 14 (1)

- Jul 13 (1)

- Jul 12 (4)

- Jul 11 (6)

- Jul 10 (6)

- Jul 09 (7)

- Jul 08 (7)

- Jul 07 (7)

- Jul 02 (8)

- Jul 01 (6)

-

►

June

(141)

- Jun 30 (6)

- Jun 27 (7)

- Jun 26 (6)

- Jun 25 (7)

- Jun 24 (8)

- Jun 23 (1)

- Jun 22 (4)

- Jun 20 (9)

- Jun 19 (9)

- Jun 18 (5)

- Jun 17 (4)

- Jun 16 (5)

- Jun 13 (8)

- Jun 12 (6)

- Jun 11 (7)

- Jun 10 (6)

- Jun 09 (7)

- Jun 06 (8)

- Jun 05 (6)

- Jun 04 (8)

- Jun 03 (9)

- Jun 02 (5)

-

►

May

(144)

- May 30 (5)

- May 29 (6)

- May 28 (7)

- May 27 (6)

- May 23 (7)

- May 22 (10)

- May 21 (6)

- May 20 (9)

- May 19 (6)

- May 16 (7)

- May 15 (7)

- May 14 (7)

- May 13 (8)

- May 12 (7)

- May 09 (7)

- May 08 (7)

- May 07 (7)

- May 06 (6)

- May 05 (5)

- May 02 (7)

- May 01 (7)

-

►

April

(153)

- Apr 30 (7)

- Apr 29 (5)

- Apr 28 (4)

- Apr 26 (4)

- Apr 25 (7)

- Apr 24 (8)

- Apr 23 (5)

- Apr 22 (6)

- Apr 21 (4)

- Apr 19 (3)

- Apr 18 (7)

- Apr 17 (5)

- Apr 16 (7)

- Apr 15 (7)

- Apr 14 (5)

- Apr 12 (2)

- Apr 11 (7)

- Apr 10 (6)

- Apr 09 (7)

- Apr 08 (8)

- Apr 07 (7)

- Apr 04 (7)

- Apr 03 (7)

- Apr 02 (7)

- Apr 01 (11)

-

►

March

(154)

- Mar 28 (10)

- Mar 27 (8)

- Mar 26 (9)

- Mar 25 (10)

- Mar 24 (7)

- Mar 21 (8)

- Mar 20 (5)

- Mar 19 (8)

- Mar 18 (7)

- Mar 17 (6)

- Mar 14 (10)

- Mar 13 (5)

- Mar 12 (7)

- Mar 11 (8)

- Mar 10 (6)

- Mar 07 (7)

- Mar 06 (10)

- Mar 05 (6)

- Mar 04 (7)

- Mar 03 (10)

-

►

August

(121)

-

►

2023

(1752)

-

►

December

(111)

- Dec 21 (5)

- Dec 20 (7)

- Dec 19 (7)

- Dec 18 (7)

- Dec 17 (7)

- Dec 14 (6)

- Dec 13 (6)

- Dec 12 (8)

- Dec 11 (9)

- Dec 10 (7)

- Dec 07 (9)

- Dec 06 (11)

- Dec 05 (7)

- Dec 04 (7)

- Dec 03 (4)

- Dec 01 (4)

-

►

November

(149)

- Nov 30 (8)

- Nov 29 (8)

- Nov 28 (6)

- Nov 27 (7)

- Nov 26 (6)

- Nov 21 (8)

- Nov 20 (6)

- Nov 19 (6)

- Nov 16 (6)

- Nov 15 (7)

- Nov 14 (9)

- Nov 13 (10)

- Nov 12 (7)

- Nov 09 (8)

- Nov 08 (8)

- Nov 07 (8)

- Nov 06 (5)

- Nov 05 (7)

- Nov 03 (1)

- Nov 02 (9)

- Nov 01 (9)

-

►

October

(161)

- Oct 31 (8)

- Oct 30 (7)

- Oct 29 (7)

- Oct 26 (9)

- Oct 25 (8)

- Oct 24 (7)

- Oct 23 (8)

- Oct 22 (8)

- Oct 19 (5)

- Oct 18 (9)

- Oct 17 (6)

- Oct 16 (8)

- Oct 15 (7)

- Oct 14 (1)

- Oct 12 (7)

- Oct 11 (6)

- Oct 10 (9)

- Oct 09 (5)

- Oct 05 (5)

- Oct 04 (11)

- Oct 03 (5)

- Oct 02 (9)

- Oct 01 (6)

-

►

September

(130)

- Sep 28 (9)

- Sep 27 (8)

- Sep 26 (7)

- Sep 25 (6)

- Sep 22 (5)

- Sep 21 (6)

- Sep 20 (8)

- Sep 19 (6)

- Sep 18 (5)

- Sep 17 (6)

- Sep 14 (6)

- Sep 13 (9)

- Sep 12 (6)

- Sep 11 (6)

- Sep 10 (5)

- Sep 07 (8)

- Sep 06 (8)

- Sep 05 (10)

- Sep 04 (6)

-

►

August

(163)

- Aug 31 (7)

- Aug 30 (8)

- Aug 29 (8)

- Aug 28 (7)

- Aug 27 (2)

- Aug 25 (3)

- Aug 24 (6)

- Aug 23 (8)

- Aug 22 (9)

- Aug 21 (7)

- Aug 20 (4)

- Aug 17 (5)

- Aug 16 (7)

- Aug 15 (7)

- Aug 14 (6)

- Aug 13 (7)

- Aug 11 (2)

- Aug 10 (8)

- Aug 09 (7)

- Aug 08 (5)

- Aug 07 (10)

- Aug 06 (7)

- Aug 03 (8)

- Aug 02 (8)

- Aug 01 (7)

-

►

July

(158)

- Jul 31 (8)

- Jul 30 (8)

- Jul 27 (7)

- Jul 26 (8)

- Jul 25 (10)

- Jul 24 (6)

- Jul 23 (3)

- Jul 22 (1)

- Jul 21 (2)

- Jul 20 (7)

- Jul 19 (10)

- Jul 18 (11)

- Jul 17 (8)

- Jul 16 (5)

- Jul 15 (2)

- Jul 13 (8)

- Jul 12 (7)

- Jul 11 (11)

- Jul 10 (6)

- Jul 09 (6)

- Jul 06 (7)

- Jul 05 (10)

- Jul 04 (7)

-

►

June

(131)

- Jun 29 (6)

- Jun 28 (7)

- Jun 27 (7)

- Jun 26 (6)

- Jun 25 (7)

- Jun 22 (7)

- Jun 21 (9)

- Jun 20 (6)

- Jun 19 (9)

- Jun 15 (6)

- Jun 14 (6)

- Jun 13 (7)

- Jun 12 (6)

- Jun 11 (5)

- Jun 08 (6)

- Jun 07 (9)

- Jun 06 (5)

- Jun 05 (5)

- Jun 04 (6)

- Jun 01 (6)

-

►

May

(152)

- May 31 (6)

- May 30 (7)

- May 29 (6)

- May 25 (6)

- May 24 (6)

- May 23 (8)

- May 22 (6)

- May 21 (9)

- May 18 (5)

- May 17 (6)

- May 16 (7)

- May 15 (9)

- May 14 (6)

- May 12 (4)

- May 11 (7)

- May 10 (7)

- May 09 (5)

- May 08 (7)

- May 07 (3)

- May 05 (3)

- May 04 (9)

- May 03 (6)

- May 02 (8)

- May 01 (6)

-

►

April

(145)

- Apr 30 (4)

- Apr 29 (1)

- Apr 28 (2)

- Apr 27 (6)

- Apr 26 (10)

- Apr 25 (7)

- Apr 24 (7)

- Apr 23 (3)

- Apr 21 (2)

- Apr 20 (7)

- Apr 19 (8)

- Apr 18 (9)

- Apr 17 (7)

- Apr 16 (5)

- Apr 14 (2)

- Apr 13 (7)

- Apr 12 (6)

- Apr 11 (7)

- Apr 10 (9)

- Apr 09 (5)

- Apr 08 (1)

- Apr 07 (1)

- Apr 06 (1)

- Apr 05 (8)

- Apr 04 (7)

- Apr 03 (9)

- Apr 02 (4)

-

►

March

(157)

- Mar 31 (2)

- Mar 30 (8)

- Mar 29 (8)

- Mar 28 (6)

- Mar 27 (6)

- Mar 26 (4)

- Mar 24 (3)

- Mar 23 (7)

- Mar 22 (7)

- Mar 21 (7)

- Mar 20 (6)

- Mar 19 (6)

- Mar 16 (7)

- Mar 15 (7)

- Mar 14 (6)

- Mar 13 (7)

- Mar 12 (7)

- Mar 09 (10)

- Mar 08 (6)

- Mar 07 (8)

- Mar 06 (7)

- Mar 05 (4)

- Mar 04 (2)

- Mar 03 (4)

- Mar 02 (4)

- Mar 01 (8)

-

►

December

(111)

-

►

2022

(1901)

-

►

December

(99)

- Dec 28 (1)

- Dec 27 (1)

- Dec 19 (8)

- Dec 18 (3)

- Dec 16 (4)

- Dec 15 (7)

- Dec 14 (7)

- Dec 13 (6)

- Dec 12 (7)

- Dec 11 (6)

- Dec 08 (10)

- Dec 07 (8)

- Dec 06 (6)

- Dec 05 (8)

- Dec 04 (5)

- Dec 03 (3)

- Dec 01 (9)

-

►

November

(160)

- Nov 30 (6)

- Nov 29 (8)

- Nov 28 (7)

- Nov 27 (7)

- Nov 26 (2)

- Nov 22 (9)

- Nov 21 (7)

- Nov 20 (8)

- Nov 17 (9)

- Nov 16 (10)

- Nov 15 (8)

- Nov 14 (6)

- Nov 13 (7)

- Nov 10 (7)

- Nov 09 (10)

- Nov 08 (10)

- Nov 07 (8)

- Nov 06 (6)

- Nov 03 (10)

- Nov 02 (8)

- Nov 01 (7)

-

►

October

(174)

- Oct 31 (8)

- Oct 30 (6)

- Oct 27 (9)

- Oct 26 (9)

- Oct 25 (10)

- Oct 24 (9)

- Oct 23 (7)

- Oct 20 (7)

- Oct 19 (8)

- Oct 18 (9)

- Oct 17 (9)

- Oct 16 (8)

- Oct 13 (7)

- Oct 12 (8)

- Oct 11 (11)

- Oct 10 (5)

- Oct 08 (4)

- Oct 06 (7)

- Oct 05 (9)

- Oct 04 (9)

- Oct 03 (7)

- Oct 02 (8)

-

►

September

(132)

- Sep 29 (4)

- Sep 28 (5)

- Sep 27 (6)

- Sep 26 (7)

- Sep 25 (6)

- Sep 22 (8)

- Sep 21 (6)

- Sep 20 (3)

- Sep 19 (10)

- Sep 18 (10)

- Sep 17 (1)

- Sep 15 (7)

- Sep 14 (7)

- Sep 13 (8)

- Sep 12 (7)

- Sep 11 (4)

- Sep 10 (1)

- Sep 09 (3)

- Sep 08 (6)

- Sep 07 (6)

- Sep 06 (5)

- Sep 05 (6)

- Sep 02 (1)

- Sep 01 (5)

-

►

August

(173)

- Aug 31 (10)

- Aug 30 (7)

- Aug 29 (6)

- Aug 28 (6)

- Aug 25 (8)

- Aug 24 (10)

- Aug 23 (8)

- Aug 22 (7)

- Aug 21 (1)

- Aug 20 (1)

- Aug 19 (3)

- Aug 18 (8)

- Aug 17 (10)

- Aug 16 (9)

- Aug 15 (6)

- Aug 14 (2)

- Aug 12 (4)

- Aug 11 (8)

- Aug 10 (8)

- Aug 09 (7)

- Aug 08 (7)

- Aug 07 (5)

- Aug 05 (2)

- Aug 04 (6)

- Aug 03 (9)

- Aug 02 (8)

- Aug 01 (7)

-

►

July

(160)

- Jul 31 (7)

- Jul 28 (12)

- Jul 27 (6)

- Jul 26 (7)

- Jul 25 (7)

- Jul 24 (4)

- Jul 22 (7)

- Jul 21 (8)

- Jul 20 (8)

- Jul 19 (11)

- Jul 18 (9)

- Jul 17 (2)

- Jul 15 (7)

- Jul 14 (7)

- Jul 13 (9)

- Jul 12 (7)

- Jul 11 (9)

- Jul 10 (5)

- Jul 08 (2)

- Jul 07 (7)

- Jul 06 (7)

- Jul 05 (6)

- Jul 03 (1)

- Jul 02 (4)

- Jul 01 (1)

-

►

June

(167)

- Jun 30 (8)

- Jun 29 (8)

- Jun 28 (8)

- Jun 27 (8)

- Jun 26 (2)

- Jun 25 (6)

- Jun 23 (7)

- Jun 22 (9)

- Jun 21 (10)

- Jun 20 (7)

- Jun 16 (9)

- Jun 15 (7)

- Jun 14 (9)

- Jun 13 (6)

- Jun 12 (8)

- Jun 11 (3)

- Jun 09 (5)

- Jun 08 (8)

- Jun 07 (8)

- Jun 06 (7)

- Jun 05 (1)

- Jun 04 (2)

- Jun 03 (3)

- Jun 02 (8)

- Jun 01 (10)

-

►

May

(168)

- May 31 (8)

- May 30 (7)

- May 26 (8)

- May 25 (8)

- May 24 (7)

- May 23 (7)

- May 22 (6)

- May 19 (7)

- May 18 (8)

- May 17 (7)

- May 16 (7)

- May 14 (7)

- May 12 (9)

- May 11 (8)

- May 10 (7)

- May 09 (10)

- May 08 (2)

- May 07 (2)

- May 06 (4)

- May 05 (9)

- May 04 (11)

- May 03 (11)

- May 02 (8)

-

►

April

(147)

- Apr 30 (4)

- Apr 29 (2)

- Apr 28 (6)

- Apr 27 (9)

- Apr 26 (8)

- Apr 25 (7)

- Apr 24 (1)

- Apr 23 (6)

- Apr 21 (7)

- Apr 20 (10)

- Apr 19 (7)

- Apr 18 (7)

- Apr 14 (8)

- Apr 13 (9)

- Apr 12 (8)

- Apr 11 (6)

- Apr 10 (5)

- Apr 09 (1)

- Apr 07 (7)

- Apr 06 (6)

- Apr 05 (8)

- Apr 04 (7)

- Apr 03 (3)

- Apr 02 (2)

- Apr 01 (3)

-

►

March

(200)

- Mar 31 (7)

- Mar 30 (8)

- Mar 29 (7)

- Mar 28 (11)

- Mar 27 (7)

- Mar 25 (1)

- Mar 24 (7)

- Mar 23 (10)

- Mar 22 (7)

- Mar 21 (8)

- Mar 20 (8)

- Mar 17 (9)

- Mar 16 (9)

- Mar 15 (8)

- Mar 14 (8)

- Mar 13 (8)

- Mar 10 (15)

- Mar 09 (11)

- Mar 08 (10)

- Mar 07 (9)

- Mar 06 (6)

- Mar 05 (1)

- Mar 04 (2)

- Mar 03 (6)

- Mar 02 (7)

- Mar 01 (10)

-

►

December

(99)

-

►

2021

(1954)

-

►

December

(135)

- Dec 29 (3)

- Dec 28 (3)

- Dec 24 (1)

- Dec 23 (2)

- Dec 22 (1)

- Dec 21 (7)

- Dec 20 (12)

- Dec 19 (8)

- Dec 16 (9)

- Dec 15 (7)

- Dec 14 (9)

- Dec 13 (8)

- Dec 12 (7)

- Dec 09 (9)

- Dec 08 (10)

- Dec 07 (11)

- Dec 06 (10)

- Dec 05 (6)

- Dec 02 (6)

- Dec 01 (6)

-

►

November

(167)

- Nov 30 (8)

- Nov 29 (7)

- Nov 28 (7)

- Nov 24 (1)

- Nov 23 (10)

- Nov 22 (7)

- Nov 21 (7)

- Nov 18 (9)

- Nov 17 (10)

- Nov 16 (9)

- Nov 15 (7)

- Nov 14 (10)

- Nov 11 (8)

- Nov 10 (11)

- Nov 09 (7)

- Nov 08 (8)

- Nov 07 (7)

- Nov 05 (1)

- Nov 04 (9)

- Nov 03 (8)

- Nov 02 (7)

- Nov 01 (9)

-

►

October

(142)

- Oct 31 (4)

- Oct 28 (9)

- Oct 27 (8)

- Oct 26 (8)

- Oct 25 (8)

- Oct 24 (8)

- Oct 21 (5)

- Oct 20 (8)

- Oct 19 (7)

- Oct 18 (7)

- Oct 17 (6)

- Oct 14 (8)

- Oct 13 (10)

- Oct 12 (6)

- Oct 11 (7)

- Oct 07 (7)

- Oct 06 (11)

- Oct 05 (6)

- Oct 04 (9)

-

►

September

(167)

- Sep 30 (7)

- Sep 29 (7)

- Sep 28 (9)

- Sep 27 (8)

- Sep 26 (6)

- Sep 24 (1)

- Sep 23 (9)

- Sep 22 (8)

- Sep 21 (10)

- Sep 20 (7)

- Sep 19 (5)

- Sep 16 (10)

- Sep 15 (11)

- Sep 14 (11)

- Sep 13 (7)

- Sep 12 (6)

- Sep 10 (1)

- Sep 09 (9)

- Sep 08 (7)

- Sep 07 (12)

- Sep 02 (9)

- Sep 01 (7)

-

►

August

(162)

- Aug 31 (10)

- Aug 30 (9)

- Aug 28 (6)

- Aug 27 (2)

- Aug 26 (8)

- Aug 25 (9)

- Aug 24 (7)

- Aug 23 (8)

- Aug 19 (6)

- Aug 18 (6)

- Aug 17 (7)

- Aug 16 (7)

- Aug 15 (3)

- Aug 13 (2)

- Aug 12 (8)

- Aug 11 (6)

- Aug 10 (8)

- Aug 09 (6)

- Aug 08 (5)

- Aug 06 (2)

- Aug 05 (8)

- Aug 04 (9)

- Aug 03 (6)

- Aug 02 (8)

- Aug 01 (6)

-

►

July

(156)

- Jul 31 (1)

- Jul 30 (1)

- Jul 29 (11)

- Jul 27 (8)

- Jul 26 (6)

- Jul 25 (7)

- Jul 22 (9)

- Jul 21 (9)

- Jul 20 (9)

- Jul 19 (10)

- Jul 18 (4)

- Jul 16 (2)

- Jul 15 (7)

- Jul 14 (7)

- Jul 13 (10)

- Jul 12 (9)

- Jul 11 (7)

- Jul 08 (7)

- Jul 07 (7)

- Jul 06 (9)

- Jul 05 (9)

- Jul 01 (7)

-

►

June

(194)

- Jun 30 (10)

- Jun 29 (8)

- Jun 28 (9)

- Jun 27 (8)

- Jun 24 (9)

- Jun 23 (8)

- Jun 22 (8)

- Jun 21 (8)

- Jun 19 (7)

- Jun 17 (7)

- Jun 16 (7)

- Jun 15 (11)

- Jun 14 (10)

- Jun 13 (8)

- Jun 12 (2)

- Jun 11 (1)

- Jun 10 (9)

- Jun 09 (11)

- Jun 08 (9)

- Jun 07 (7)

- Jun 06 (9)

- Jun 03 (7)

- Jun 02 (11)

- Jun 01 (10)

-

►

May

(155)

- May 31 (7)

- May 27 (7)

- May 26 (8)

- May 25 (6)

- May 24 (8)

- May 23 (6)

- May 20 (8)

- May 19 (5)

- May 18 (8)

- May 17 (6)

- May 16 (8)

- May 13 (9)

- May 12 (9)

- May 11 (9)

- May 10 (7)

- May 09 (8)

- May 06 (6)

- May 05 (11)

- May 04 (9)

- May 03 (5)

- May 02 (5)

-

►

April

(168)

- Apr 29 (10)

- Apr 28 (13)

- Apr 27 (9)

- Apr 26 (9)

- Apr 25 (9)

- Apr 23 (1)

- Apr 22 (8)

- Apr 21 (8)

- Apr 20 (10)

- Apr 19 (9)

- Apr 15 (10)

- Apr 14 (8)

- Apr 13 (8)

- Apr 12 (7)

- Apr 11 (6)

- Apr 08 (9)

- Apr 07 (12)

- Apr 06 (9)

- Apr 05 (6)

- Apr 04 (6)

- Apr 02 (1)

-

►

March

(200)

- Mar 31 (9)

- Mar 30 (8)

- Mar 29 (7)

- Mar 28 (8)

- Mar 25 (9)

- Mar 24 (12)

- Mar 23 (11)

- Mar 22 (6)

- Mar 21 (6)

- Mar 18 (10)

- Mar 17 (9)

- Mar 16 (10)

- Mar 15 (10)

- Mar 14 (6)

- Mar 13 (1)

- Mar 12 (1)

- Mar 11 (8)

- Mar 10 (8)

- Mar 09 (9)

- Mar 08 (8)

- Mar 07 (1)

- Mar 05 (1)

- Mar 04 (11)

- Mar 03 (10)

- Mar 02 (13)

- Mar 01 (8)

-

►

December

(135)

-

▼

2020

(2044)

-

►

December

(150)

- Dec 28 (2)

- Dec 26 (1)

- Dec 23 (1)

- Dec 21 (6)

- Dec 20 (7)

- Dec 18 (1)

- Dec 17 (9)

- Dec 16 (12)

- Dec 15 (13)

- Dec 14 (12)

- Dec 13 (8)

- Dec 11 (1)

- Dec 10 (8)

- Dec 09 (12)

- Dec 08 (11)

- Dec 07 (10)

- Dec 06 (11)

- Dec 03 (8)

- Dec 02 (7)

- Dec 01 (10)

-

►

November

(145)

- Nov 30 (8)

- Nov 29 (4)

- Nov 27 (1)

- Nov 25 (1)

- Nov 24 (10)

- Nov 23 (6)

- Nov 22 (7)

- Nov 19 (7)

- Nov 18 (8)

- Nov 17 (8)

- Nov 16 (7)

- Nov 15 (6)

- Nov 12 (9)

- Nov 11 (7)

- Nov 10 (7)

- Nov 09 (8)

- Nov 08 (6)

- Nov 05 (9)

- Nov 04 (6)

- Nov 03 (4)

- Nov 02 (9)

- Nov 01 (7)

-

►

October

(174)

- Oct 29 (12)

- Oct 28 (12)

- Oct 27 (8)

- Oct 26 (7)

- Oct 25 (8)

- Oct 22 (10)

- Oct 21 (8)

- Oct 20 (8)

- Oct 19 (9)

- Oct 18 (7)

- Oct 15 (9)

- Oct 14 (7)

- Oct 13 (8)

- Oct 12 (9)

- Oct 08 (10)

- Oct 07 (9)

- Oct 06 (11)

- Oct 05 (6)

- Oct 04 (7)

- Oct 01 (9)

-

►

September

(164)

- Sep 30 (11)

- Sep 29 (7)

- Sep 28 (10)

- Sep 27 (6)

- Sep 24 (7)

- Sep 23 (8)

- Sep 22 (9)

- Sep 21 (7)

- Sep 20 (1)

- Sep 18 (3)

- Sep 17 (6)

- Sep 16 (8)

- Sep 15 (9)

- Sep 14 (9)

- Sep 13 (7)

- Sep 10 (8)

- Sep 09 (8)

- Sep 08 (7)

- Sep 07 (7)

- Sep 03 (10)

- Sep 02 (9)

- Sep 01 (7)

-

►

August

(165)

- Aug 31 (9)

- Aug 30 (7)

- Aug 27 (8)

- Aug 26 (7)

- Aug 25 (6)

- Aug 24 (6)

- Aug 23 (5)

- Aug 20 (6)

- Aug 19 (8)

- Aug 18 (9)

- Aug 17 (6)

- Aug 16 (6)

- Aug 13 (5)

- Aug 12 (7)

- Aug 11 (10)

- Aug 10 (6)

- Aug 09 (6)

- Aug 06 (11)

- Aug 05 (11)

- Aug 04 (10)

- Aug 03 (8)

- Aug 02 (8)

-

►

July

(170)

- Jul 30 (11)

- Jul 29 (10)

- Jul 28 (9)

- Jul 27 (6)

- Jul 26 (7)

- Jul 23 (9)

- Jul 22 (11)

- Jul 21 (6)

- Jul 20 (9)

- Jul 19 (8)

- Jul 16 (9)

- Jul 15 (8)

- Jul 14 (8)

- Jul 13 (9)

- Jul 12 (8)

- Jul 09 (9)

- Jul 08 (10)

- Jul 07 (8)

- Jul 06 (7)

- Jul 04 (1)

- Jul 01 (7)

-

►

June

(181)

- Jun 30 (8)

- Jun 29 (9)

- Jun 28 (7)

- Jun 26 (2)

- Jun 25 (13)

- Jun 24 (9)

- Jun 23 (8)

- Jun 22 (7)

- Jun 21 (9)

- Jun 18 (9)

- Jun 17 (6)

- Jun 16 (7)

- Jun 15 (9)

- Jun 14 (8)

- Jun 11 (7)

- Jun 10 (9)

- Jun 09 (7)

- Jun 08 (8)

- Jun 07 (9)

- Jun 04 (9)

- Jun 03 (8)

- Jun 02 (7)

- Jun 01 (6)

-

►

May

(172)

- May 31 (5)

- May 28 (7)

- May 27 (9)

- May 26 (10)

- May 25 (10)

- May 21 (8)

- May 20 (13)

- May 19 (10)

- May 18 (12)

- May 17 (1)

- May 15 (7)

- May 14 (7)

- May 13 (8)

- May 12 (9)

- May 11 (7)

- May 10 (6)

- May 07 (11)

- May 06 (8)

- May 05 (9)

- May 04 (8)

- May 03 (7)

-

►

April

(175)

- Apr 30 (10)

- Apr 29 (11)

- Apr 28 (9)

- Apr 27 (9)

- Apr 26 (10)

- Apr 23 (8)

- Apr 22 (8)

- Apr 21 (13)

- Apr 20 (6)

- Apr 19 (7)

- Apr 16 (7)

- Apr 15 (7)

- Apr 14 (11)

- Apr 13 (7)

- Apr 09 (10)

- Apr 08 (6)

- Apr 07 (9)

- Apr 06 (9)

- Apr 05 (5)

- Apr 02 (6)

- Apr 01 (7)

-

►

March

(197)

- Mar 31 (7)

- Mar 30 (7)

- Mar 29 (8)

- Mar 26 (8)

- Mar 25 (8)

- Mar 24 (8)

- Mar 23 (7)

- Mar 22 (10)

- Mar 19 (9)

- Mar 18 (10)

- Mar 17 (7)

- Mar 16 (8)

- Mar 15 (4)

- Mar 14 (8)

- Mar 12 (8)

- Mar 11 (10)

- Mar 10 (10)

- Mar 09 (10)

- Mar 08 (6)

- Mar 05 (7)

- Mar 04 (10)

- Mar 03 (9)

- Mar 02 (9)

- Mar 01 (9)

-

►

December

(150)

-

►

2019

(2147)

-

►

December

(134)

- Dec 27 (1)

- Dec 26 (2)

- Dec 20 (2)

- Dec 19 (8)

- Dec 18 (7)

- Dec 17 (8)

- Dec 16 (10)

- Dec 15 (5)

- Dec 12 (7)

- Dec 11 (9)

- Dec 10 (7)

- Dec 09 (9)

- Dec 08 (10)

- Dec 05 (12)

- Dec 04 (9)

- Dec 03 (11)

- Dec 02 (9)

- Dec 01 (8)

-

►

November

(157)

- Nov 30 (1)

- Nov 29 (1)

- Nov 26 (8)

- Nov 25 (11)

- Nov 24 (12)

- Nov 21 (12)

- Nov 20 (4)

- Nov 19 (11)

- Nov 18 (9)

- Nov 17 (7)

- Nov 14 (9)

- Nov 13 (10)

- Nov 12 (9)

- Nov 11 (9)

- Nov 07 (9)

- Nov 06 (9)

- Nov 05 (10)

- Nov 04 (7)

- Nov 03 (9)

-

►

October

(199)

- Oct 31 (7)

- Oct 30 (11)

- Oct 29 (13)

- Oct 28 (13)

- Oct 27 (8)

- Oct 25 (1)

- Oct 24 (9)

- Oct 23 (7)

- Oct 22 (7)

- Oct 21 (7)

- Oct 20 (8)

- Oct 17 (8)

- Oct 16 (12)

- Oct 15 (8)

- Oct 14 (11)

- Oct 10 (8)

- Oct 09 (10)

- Oct 08 (8)

- Oct 07 (7)

- Oct 06 (6)

- Oct 03 (9)

- Oct 02 (10)

- Oct 01 (11)

-

►

September

(178)

- Sep 30 (8)

- Sep 29 (6)

- Sep 26 (6)

- Sep 25 (10)

- Sep 24 (11)

- Sep 23 (10)

- Sep 22 (8)

- Sep 19 (13)

- Sep 18 (7)

- Sep 17 (9)

- Sep 16 (7)

- Sep 15 (9)

- Sep 12 (8)

- Sep 11 (9)

- Sep 10 (8)

- Sep 09 (8)

- Sep 08 (6)

- Sep 05 (8)

- Sep 04 (8)

- Sep 03 (10)

- Sep 02 (9)

-

►

August

(160)

- Aug 30 (1)

- Aug 28 (10)

- Aug 27 (8)

- Aug 26 (8)

- Aug 25 (6)

- Aug 22 (11)

- Aug 21 (8)

- Aug 20 (7)

- Aug 19 (7)

- Aug 18 (8)

- Aug 16 (1)

- Aug 15 (6)

- Aug 14 (7)

- Aug 13 (6)

- Aug 12 (7)

- Aug 11 (11)

- Aug 08 (6)

- Aug 07 (9)

- Aug 06 (8)

- Aug 05 (8)

- Aug 04 (7)

- Aug 01 (10)

-

►

July

(170)

- Jul 31 (13)

- Jul 30 (9)

- Jul 29 (6)

- Jul 28 (1)

- Jul 26 (6)

- Jul 25 (8)

- Jul 24 (10)

- Jul 23 (8)

- Jul 22 (6)

- Jul 21 (8)

- Jul 18 (7)

- Jul 17 (9)

- Jul 16 (8)

- Jul 15 (6)

- Jul 14 (8)

- Jul 11 (7)

- Jul 10 (9)

- Jul 09 (9)

- Jul 08 (8)

- Jul 07 (7)

- Jul 02 (9)

- Jul 01 (8)

-

►

June

(181)

- Jun 30 (7)

- Jun 28 (2)

- Jun 27 (9)

- Jun 26 (9)

- Jun 25 (9)

- Jun 24 (10)

- Jun 23 (3)

- Jun 21 (5)

- Jun 20 (6)

- Jun 19 (10)

- Jun 18 (10)

- Jun 17 (9)

- Jun 16 (3)

- Jun 14 (4)

- Jun 13 (8)

- Jun 12 (9)

- Jun 11 (7)

- Jun 10 (7)

- Jun 09 (11)

- Jun 06 (11)

- Jun 05 (8)

- Jun 04 (8)

- Jun 03 (8)

- Jun 02 (8)

-

►

May

(182)

- May 30 (10)

- May 29 (13)

- May 28 (8)

- May 27 (6)

- May 24 (1)

- May 23 (8)

- May 22 (9)

- May 21 (8)

- May 20 (9)

- May 19 (6)

- May 17 (1)

- May 16 (7)

- May 15 (8)

- May 14 (8)

- May 12 (8)

- May 09 (11)

- May 08 (8)

- May 07 (13)

- May 06 (11)

- May 05 (10)

- May 02 (7)

- May 01 (12)

-

►

April

(189)

- Apr 30 (13)

- Apr 29 (10)

- Apr 28 (8)

- Apr 27 (1)

- Apr 25 (13)

- Apr 24 (11)

- Apr 23 (10)

- Apr 22 (10)

- Apr 17 (8)

- Apr 16 (8)

- Apr 15 (8)

- Apr 14 (4)

- Apr 13 (1)

- Apr 12 (4)

- Apr 11 (10)

- Apr 10 (9)

- Apr 09 (10)

- Apr 08 (12)

- Apr 07 (1)

- Apr 06 (1)

- Apr 05 (4)

- Apr 04 (7)

- Apr 03 (9)

- Apr 02 (7)

- Apr 01 (10)

-

►

March

(196)

- Mar 31 (8)

- Mar 28 (8)

- Mar 27 (9)

- Mar 26 (9)

- Mar 25 (10)

- Mar 24 (4)

- Mar 23 (5)

- Mar 22 (1)

- Mar 21 (7)

- Mar 20 (10)

- Mar 19 (8)

- Mar 18 (10)

- Mar 15 (10)

- Mar 14 (11)

- Mar 13 (9)

- Mar 12 (11)

- Mar 11 (9)

- Mar 10 (1)

- Mar 07 (12)

- Mar 06 (14)

- Mar 05 (9)

- Mar 04 (9)

- Mar 03 (7)

- Mar 01 (5)

-

►

December

(134)

-

►

2018

(2255)

-

►

December

(162)

- Dec 31 (4)

- Dec 28 (1)

- Dec 27 (2)

- Dec 24 (1)

- Dec 22 (1)

- Dec 20 (9)

- Dec 19 (9)

- Dec 18 (9)

- Dec 17 (12)

- Dec 16 (8)

- Dec 15 (1)

- Dec 14 (1)

- Dec 13 (9)

- Dec 12 (14)

- Dec 11 (10)

- Dec 10 (12)

- Dec 09 (4)

- Dec 07 (6)

- Dec 06 (11)

- Dec 05 (11)

- Dec 04 (11)

- Dec 03 (13)

- Dec 02 (3)

-

►

November

(202)

- Nov 30 (6)

- Nov 29 (10)

- Nov 28 (9)

- Nov 27 (8)

- Nov 26 (9)

- Nov 25 (1)

- Nov 24 (4)

- Nov 23 (2)

- Nov 21 (5)

- Nov 20 (12)

- Nov 19 (10)

- Nov 18 (13)

- Nov 15 (10)

- Nov 14 (12)

- Nov 13 (11)

- Nov 12 (11)

- Nov 08 (10)

- Nov 07 (10)

- Nov 06 (11)

- Nov 05 (13)

- Nov 04 (12)

- Nov 01 (13)

-

►

October

(201)

- Oct 31 (9)

- Oct 30 (9)

- Oct 29 (7)

- Oct 28 (9)

- Oct 25 (14)

- Oct 24 (9)

- Oct 23 (10)

- Oct 22 (7)

- Oct 21 (9)

- Oct 18 (11)

- Oct 17 (8)

- Oct 16 (13)

- Oct 15 (9)

- Oct 14 (8)

- Oct 11 (7)

- Oct 10 (9)

- Oct 09 (10)

- Oct 08 (8)

- Oct 07 (1)

- Oct 04 (8)

- Oct 03 (8)

- Oct 02 (7)

- Oct 01 (11)

-

►

September

(180)

- Sep 30 (8)

- Sep 27 (8)

- Sep 26 (8)

- Sep 25 (10)

- Sep 24 (10)

- Sep 23 (9)

- Sep 20 (10)

- Sep 19 (11)

- Sep 18 (8)

- Sep 17 (9)

- Sep 16 (11)

- Sep 13 (10)

- Sep 12 (6)

- Sep 11 (7)

- Sep 10 (9)

- Sep 09 (9)

- Sep 06 (11)

- Sep 05 (11)

- Sep 04 (7)

- Sep 03 (4)

- Sep 02 (2)

- Sep 01 (2)

-

►

August

(203)

- Aug 31 (1)

- Aug 30 (9)

- Aug 29 (8)

- Aug 28 (9)

- Aug 27 (10)

- Aug 26 (5)

- Aug 25 (3)

- Aug 24 (1)

- Aug 23 (8)

- Aug 22 (7)

- Aug 21 (10)

- Aug 20 (8)

- Aug 19 (7)

- Aug 16 (7)

- Aug 15 (12)

- Aug 14 (10)

- Aug 13 (11)

- Aug 12 (9)

- Aug 09 (10)

- Aug 08 (9)

- Aug 07 (8)

- Aug 06 (13)

- Aug 05 (5)

- Aug 04 (1)

- Aug 03 (4)

- Aug 02 (8)

- Aug 01 (10)

-

►

July

(194)

- Jul 31 (10)

- Jul 30 (12)

- Jul 29 (1)

- Jul 28 (2)

- Jul 27 (1)

- Jul 26 (10)

- Jul 25 (14)

- Jul 24 (8)

- Jul 23 (9)

- Jul 22 (4)

- Jul 20 (6)

- Jul 19 (10)

- Jul 18 (12)

- Jul 17 (9)

- Jul 16 (6)

- Jul 15 (8)

- Jul 12 (9)

- Jul 11 (11)

- Jul 10 (9)

- Jul 09 (7)

- Jul 08 (8)

- Jul 07 (3)

- Jul 06 (1)

- Jul 05 (6)

- Jul 04 (2)

- Jul 03 (1)

- Jul 02 (10)

- Jul 01 (5)

-

►

June

(200)

- Jun 30 (2)

- Jun 29 (2)

- Jun 28 (11)

- Jun 27 (11)

- Jun 26 (10)

- Jun 25 (9)

- Jun 24 (11)

- Jun 21 (10)

- Jun 20 (10)

- Jun 19 (11)

- Jun 18 (9)

- Jun 17 (9)

- Jun 14 (9)

- Jun 13 (10)

- Jun 12 (10)

- Jun 11 (10)

- Jun 10 (8)

- Jun 09 (1)

- Jun 08 (1)

- Jun 07 (8)

- Jun 06 (10)

- Jun 05 (10)

- Jun 04 (10)

- Jun 03 (3)

- Jun 02 (1)

- Jun 01 (4)

-

►

May

(182)

- May 31 (10)

- May 30 (8)

- May 29 (11)

- May 28 (3)

- May 27 (1)

- May 25 (4)

- May 24 (6)

- May 23 (7)

- May 22 (9)

- May 21 (9)

- May 20 (6)

- May 19 (1)

- May 18 (1)

- May 17 (7)

- May 16 (5)

- May 15 (7)

- May 14 (9)

- May 13 (4)

- May 11 (5)

- May 10 (7)

- May 09 (9)

- May 08 (9)

- May 07 (10)

- May 06 (6)

- May 05 (2)

- May 03 (8)

- May 02 (8)

- May 01 (10)

-

►

April

(166)

- Apr 30 (9)

- Apr 29 (1)

- Apr 28 (3)

- Apr 27 (3)

- Apr 26 (8)

- Apr 25 (7)

- Apr 24 (7)

- Apr 23 (8)

- Apr 22 (5)

- Apr 21 (2)

- Apr 20 (4)

- Apr 19 (7)

- Apr 18 (10)

- Apr 17 (6)

- Apr 16 (6)

- Apr 14 (1)

- Apr 13 (5)

- Apr 12 (6)

- Apr 11 (10)

- Apr 10 (9)

- Apr 09 (10)

- Apr 08 (3)

- Apr 06 (3)

- Apr 05 (7)

- Apr 04 (8)

- Apr 03 (11)

- Apr 02 (7)

-

►

March

(186)

- Mar 30 (2)

- Mar 28 (6)

- Mar 27 (10)

- Mar 26 (9)

- Mar 25 (6)

- Mar 24 (2)

- Mar 23 (3)

- Mar 22 (7)

- Mar 21 (11)

- Mar 20 (12)

- Mar 19 (9)

- Mar 18 (9)

- Mar 16 (1)

- Mar 15 (9)

- Mar 14 (8)

- Mar 13 (9)

- Mar 12 (10)

- Mar 11 (6)

- Mar 10 (1)

- Mar 09 (3)

- Mar 08 (8)

- Mar 07 (10)

- Mar 06 (9)

- Mar 05 (10)

- Mar 04 (2)

- Mar 03 (6)

- Mar 02 (1)

- Mar 01 (7)

-

►

February

(182)

- Feb 28 (11)

- Feb 27 (10)

- Feb 26 (13)

- Feb 24 (3)

- Feb 23 (8)

- Feb 22 (10)

- Feb 21 (9)

- Feb 20 (9)

- Feb 19 (8)

- Feb 17 (2)

- Feb 16 (1)

- Feb 15 (8)

- Feb 14 (10)

- Feb 13 (8)

- Feb 12 (8)

- Feb 11 (3)

- Feb 10 (4)

- Feb 08 (9)

- Feb 07 (8)

- Feb 06 (10)

- Feb 05 (9)

- Feb 04 (10)

- Feb 01 (11)

-

►

January

(197)

- Jan 31 (8)

- Jan 30 (8)

- Jan 29 (12)

- Jan 28 (6)

- Jan 26 (1)

- Jan 25 (11)

- Jan 24 (11)

- Jan 23 (8)

- Jan 22 (10)

- Jan 21 (7)

- Jan 18 (8)

- Jan 17 (11)

- Jan 16 (11)

- Jan 15 (4)

- Jan 14 (4)

- Jan 13 (2)

- Jan 11 (10)

- Jan 10 (12)

- Jan 09 (11)

- Jan 08 (10)

- Jan 07 (3)

- Jan 05 (6)

- Jan 04 (13)

- Jan 03 (7)

- Jan 02 (3)

-

►

December

(162)

-

►

2017

(2049)

-

►

December

(119)

- Dec 20 (9)

- Dec 19 (8)

- Dec 18 (8)

- Dec 17 (10)

- Dec 14 (7)

- Dec 13 (10)

- Dec 12 (7)

- Dec 11 (7)

- Dec 10 (2)

- Dec 09 (6)

- Dec 07 (8)

- Dec 06 (8)

- Dec 05 (12)

- Dec 04 (7)

- Dec 03 (8)

- Dec 02 (1)

- Dec 01 (1)

-

►

November

(160)

- Nov 30 (7)

- Nov 29 (7)

- Nov 28 (7)

- Nov 27 (10)

- Nov 26 (9)

- Nov 21 (12)

- Nov 20 (9)

- Nov 19 (8)

- Nov 16 (10)

- Nov 15 (9)

- Nov 14 (7)

- Nov 13 (7)

- Nov 12 (2)

- Nov 09 (8)

- Nov 08 (9)

- Nov 07 (6)

- Nov 06 (9)

- Nov 05 (2)

- Nov 04 (2)

- Nov 03 (4)

- Nov 02 (8)

- Nov 01 (8)

-

►

October

(169)

- Oct 31 (9)

- Oct 30 (8)

- Oct 28 (6)

- Oct 27 (2)

- Oct 26 (7)

- Oct 25 (10)

- Oct 24 (6)

- Oct 23 (8)

- Oct 22 (4)

- Oct 21 (1)

- Oct 20 (1)

- Oct 19 (9)

- Oct 18 (7)

- Oct 17 (7)

- Oct 16 (6)

- Oct 15 (5)

- Oct 14 (1)

- Oct 13 (1)

- Oct 12 (7)

- Oct 11 (9)

- Oct 10 (9)

- Oct 09 (7)

- Oct 07 (1)

- Oct 05 (8)

- Oct 04 (9)

- Oct 03 (8)

- Oct 02 (10)

- Oct 01 (3)

-

►

September

(181)

- Sep 30 (3)

- Sep 29 (1)

- Sep 28 (8)

- Sep 27 (7)

- Sep 26 (7)

- Sep 25 (10)

- Sep 24 (8)

- Sep 22 (2)

- Sep 21 (10)

- Sep 20 (14)

- Sep 19 (8)

- Sep 18 (8)

- Sep 17 (9)

- Sep 14 (6)

- Sep 13 (13)

- Sep 12 (14)

- Sep 11 (10)

- Sep 10 (1)

- Sep 09 (3)

- Sep 08 (5)

- Sep 07 (8)

- Sep 06 (10)

- Sep 05 (10)

- Sep 04 (1)

- Sep 03 (1)

- Sep 01 (4)

-

►

August

(197)

- Aug 31 (8)

- Aug 30 (9)

- Aug 29 (8)

- Aug 28 (10)

- Aug 27 (7)

- Aug 24 (10)

- Aug 23 (8)

- Aug 22 (10)

- Aug 21 (8)

- Aug 20 (1)

- Aug 19 (7)

- Aug 18 (1)

- Aug 17 (8)

- Aug 16 (7)

- Aug 15 (8)

- Aug 14 (8)

- Aug 13 (1)

- Aug 12 (3)

- Aug 11 (3)

- Aug 10 (8)

- Aug 09 (9)

- Aug 08 (8)

- Aug 07 (9)

- Aug 04 (7)

- Aug 03 (13)

- Aug 02 (10)

- Aug 01 (8)

-

►

July

(163)

- Jul 31 (10)

- Jul 28 (8)

- Jul 27 (8)

- Jul 26 (11)

- Jul 25 (8)

- Jul 24 (7)

- Jul 23 (1)

- Jul 21 (6)

- Jul 20 (9)

- Jul 19 (8)

- Jul 18 (10)

- Jul 17 (13)

- Jul 14 (3)

- Jul 13 (12)

- Jul 12 (8)

- Jul 11 (9)

- Jul 10 (8)

- Jul 07 (8)

- Jul 06 (8)

- Jul 05 (8)

-

►

June

(186)

- Jun 30 (9)

- Jun 29 (8)

- Jun 28 (8)

- Jun 27 (7)

- Jun 26 (8)

- Jun 23 (9)

- Jun 22 (7)

- Jun 21 (8)

- Jun 20 (9)

- Jun 19 (8)

- Jun 16 (8)

- Jun 15 (10)

- Jun 14 (11)

- Jun 13 (11)

- Jun 12 (8)

- Jun 11 (1)

- Jun 10 (1)

- Jun 09 (7)

- Jun 08 (9)

- Jun 07 (7)

- Jun 06 (8)

- Jun 05 (8)

- Jun 03 (1)

- Jun 02 (6)

- Jun 01 (9)

-

►

May

(189)

- May 31 (9)

- May 30 (7)

- May 29 (3)

- May 26 (1)

- May 25 (7)

- May 24 (8)

- May 23 (7)

- May 22 (8)

- May 21 (1)

- May 19 (7)

- May 18 (8)

- May 17 (11)

- May 16 (15)

- May 15 (8)

- May 14 (2)

- May 13 (3)

- May 12 (3)

- May 11 (9)

- May 10 (12)

- May 09 (10)

- May 08 (10)

- May 05 (8)

- May 04 (10)

- May 03 (7)

- May 02 (11)

- May 01 (4)

-

►

April

(169)

- Apr 30 (1)

- Apr 29 (1)

- Apr 28 (8)

- Apr 27 (10)

- Apr 26 (9)

- Apr 25 (12)

- Apr 24 (9)

- Apr 23 (1)

- Apr 21 (8)

- Apr 20 (10)

- Apr 19 (7)

- Apr 18 (9)

- Apr 17 (3)

- Apr 13 (6)

- Apr 12 (8)

- Apr 11 (10)

- Apr 10 (9)

- Apr 08 (4)

- Apr 07 (5)

- Apr 06 (9)

- Apr 05 (9)

- Apr 04 (10)

- Apr 03 (8)

- Apr 02 (1)

- Apr 01 (2)

-

►

March

(217)

- Mar 31 (7)

- Mar 30 (11)

- Mar 29 (12)

- Mar 28 (10)

- Mar 27 (9)

- Mar 24 (12)

- Mar 23 (8)

- Mar 22 (9)

- Mar 21 (7)

- Mar 20 (7)

- Mar 19 (2)

- Mar 17 (5)

- Mar 16 (10)

- Mar 15 (12)

- Mar 14 (12)

- Mar 13 (9)

- Mar 10 (6)

- Mar 09 (12)

- Mar 08 (10)

- Mar 07 (12)

- Mar 06 (8)

- Mar 05 (7)

- Mar 04 (2)

- Mar 03 (2)

- Mar 02 (8)

- Mar 01 (8)

-

►

February

(152)

- Feb 28 (7)

- Feb 27 (10)

- Feb 26 (4)

- Feb 25 (2)

- Feb 24 (3)

- Feb 23 (7)

- Feb 22 (8)

- Feb 21 (9)

- Feb 19 (4)

- Feb 17 (3)

- Feb 16 (7)

- Feb 15 (9)

- Feb 14 (7)

- Feb 13 (9)

- Feb 12 (6)

- Feb 11 (1)

- Feb 10 (2)

- Feb 09 (9)

- Feb 08 (10)

- Feb 07 (6)

- Feb 06 (8)

- Feb 05 (5)

- Feb 04 (1)

- Feb 03 (2)

- Feb 02 (6)

- Feb 01 (7)

-

►

December

(119)

-

►

2016

(1770)

-

►

December

(101)

- Dec 29 (1)

- Dec 28 (2)

- Dec 23 (1)

- Dec 20 (7)

- Dec 19 (6)

- Dec 18 (6)

- Dec 15 (6)

- Dec 14 (8)

- Dec 13 (7)

- Dec 12 (7)

- Dec 10 (5)

- Dec 08 (9)

- Dec 07 (6)

- Dec 06 (9)

- Dec 05 (7)

- Dec 04 (6)

- Dec 01 (8)

-

►

November

(135)

- Nov 30 (7)

- Nov 29 (5)

- Nov 28 (8)

- Nov 27 (6)

- Nov 22 (6)

- Nov 21 (7)

- Nov 20 (5)

- Nov 17 (6)

- Nov 16 (8)

- Nov 15 (11)

- Nov 14 (11)

- Nov 13 (4)

- Nov 12 (1)

- Nov 10 (2)

- Nov 09 (7)

- Nov 08 (5)

- Nov 07 (8)

- Nov 06 (5)

- Nov 04 (3)

- Nov 03 (7)

- Nov 02 (6)

- Nov 01 (7)

-

►

October

(149)

- Oct 31 (8)

- Oct 30 (3)

- Oct 29 (2)

- Oct 28 (3)

- Oct 27 (9)

- Oct 26 (7)

- Oct 25 (7)

- Oct 24 (9)

- Oct 22 (2)

- Oct 21 (5)

- Oct 20 (7)

- Oct 19 (7)

- Oct 18 (11)

- Oct 17 (10)

- Oct 16 (6)

- Oct 13 (7)

- Oct 12 (8)

- Oct 11 (6)

- Oct 10 (6)

- Oct 06 (6)

- Oct 05 (6)

- Oct 04 (7)

- Oct 03 (6)

- Oct 02 (1)

-

►

September

(146)

- Sep 30 (4)

- Sep 29 (7)

- Sep 28 (7)

- Sep 27 (7)

- Sep 26 (6)

- Sep 25 (3)

- Sep 24 (3)

- Sep 23 (2)

- Sep 22 (8)

- Sep 21 (7)

- Sep 20 (7)

- Sep 19 (10)

- Sep 18 (3)

- Sep 15 (6)

- Sep 14 (9)

- Sep 13 (6)

- Sep 12 (7)

- Sep 11 (6)

- Sep 09 (1)

- Sep 08 (8)

- Sep 07 (11)

- Sep 06 (7)

- Sep 05 (2)

- Sep 02 (3)

- Sep 01 (6)

-

►

August

(154)

- Aug 31 (8)

- Aug 30 (6)

- Aug 29 (6)

- Aug 28 (3)

- Aug 27 (1)

- Aug 26 (1)

- Aug 25 (8)

- Aug 24 (6)

- Aug 23 (5)

- Aug 22 (6)

- Aug 21 (4)

- Aug 20 (1)

- Aug 18 (5)

- Aug 17 (4)

- Aug 16 (6)

- Aug 15 (7)

- Aug 14 (2)

- Aug 13 (1)

- Aug 12 (4)

- Aug 11 (6)

- Aug 10 (6)

- Aug 09 (7)

- Aug 08 (10)

- Aug 07 (3)

- Aug 05 (3)

- Aug 04 (8)

- Aug 03 (14)

- Aug 02 (7)

- Aug 01 (6)

-

►

July

(135)

- Jul 31 (4)

- Jul 30 (1)

- Jul 29 (4)

- Jul 28 (6)

- Jul 27 (7)

- Jul 26 (6)

- Jul 25 (8)

- Jul 23 (1)

- Jul 22 (3)

- Jul 21 (7)

- Jul 20 (11)

- Jul 19 (10)

- Jul 18 (6)

- Jul 17 (1)

- Jul 16 (2)

- Jul 15 (2)

- Jul 14 (5)

- Jul 13 (8)

- Jul 12 (7)

- Jul 11 (5)

- Jul 10 (3)

- Jul 07 (9)

- Jul 06 (9)

- Jul 05 (1)

- Jul 04 (2)

- Jul 03 (5)

- Jul 02 (1)

- Jul 01 (1)

-

►

June

(150)

- Jun 30 (4)

- Jun 29 (7)

- Jun 28 (7)

- Jun 27 (5)

- Jun 26 (3)

- Jun 25 (1)

- Jun 24 (1)

- Jun 23 (5)

- Jun 22 (8)

- Jun 21 (10)

- Jun 20 (6)

- Jun 16 (8)

- Jun 15 (7)

- Jun 14 (8)

- Jun 13 (6)

- Jun 12 (1)

- Jun 11 (3)

- Jun 10 (2)

- Jun 09 (8)

- Jun 08 (7)

- Jun 07 (7)

- Jun 06 (10)

- Jun 05 (5)

- Jun 03 (3)

- Jun 02 (8)

- Jun 01 (10)

-

►

May

(145)

- May 31 (11)

- May 30 (5)

- May 26 (9)

- May 25 (6)

- May 24 (7)

- May 23 (5)

- May 22 (4)

- May 21 (1)

- May 20 (1)

- May 19 (7)

- May 18 (8)

- May 17 (7)

- May 16 (11)

- May 12 (5)

- May 11 (8)

- May 10 (5)

- May 09 (8)

- May 07 (1)

- May 06 (6)

- May 05 (5)

- May 04 (8)

- May 03 (7)

- May 02 (7)

- May 01 (3)

-

►

April

(165)

- Apr 29 (3)

- Apr 28 (13)

- Apr 27 (8)

- Apr 26 (9)

- Apr 25 (7)

- Apr 24 (4)

- Apr 22 (3)

- Apr 21 (6)

- Apr 20 (8)

- Apr 19 (9)

- Apr 18 (10)

- Apr 17 (5)

- Apr 15 (2)

- Apr 14 (9)

- Apr 13 (7)

- Apr 12 (9)

- Apr 11 (6)

- Apr 10 (6)

- Apr 08 (1)

- Apr 07 (7)

- Apr 06 (10)

- Apr 05 (7)

- Apr 04 (8)

- Apr 01 (8)

-

►

March

(145)

- Mar 31 (5)

- Mar 30 (8)

- Mar 29 (8)

- Mar 28 (4)

- Mar 27 (2)

- Mar 24 (8)

- Mar 23 (1)

- Mar 22 (7)

- Mar 21 (9)

- Mar 17 (5)

- Mar 16 (6)

- Mar 15 (5)

- Mar 14 (4)

- Mar 13 (4)

- Mar 12 (2)

- Mar 11 (1)

- Mar 10 (7)

- Mar 09 (8)

- Mar 08 (10)

- Mar 07 (9)

- Mar 06 (5)

- Mar 05 (4)

- Mar 03 (8)

- Mar 02 (7)

- Mar 01 (8)

-

►

February

(183)

- Feb 29 (8)

- Feb 28 (1)

- Feb 27 (4)

- Feb 26 (3)

- Feb 25 (6)

- Feb 24 (10)

- Feb 23 (15)

- Feb 22 (14)

- Feb 21 (3)

- Feb 20 (10)

- Feb 19 (1)

- Feb 18 (11)

- Feb 17 (11)

- Feb 16 (8)

- Feb 15 (7)

- Feb 11 (10)

- Feb 10 (9)

- Feb 09 (9)

- Feb 08 (7)

- Feb 05 (8)

- Feb 04 (8)

- Feb 03 (6)

- Feb 02 (7)

- Feb 01 (7)

-

►

January

(162)

- Jan 31 (1)

- Jan 29 (9)

- Jan 28 (9)

- Jan 27 (6)

- Jan 26 (9)

- Jan 25 (9)

- Jan 24 (4)

- Jan 23 (1)

- Jan 22 (1)

- Jan 21 (9)

- Jan 20 (7)

- Jan 19 (9)

- Jan 18 (6)

- Jan 17 (1)

- Jan 16 (1)

- Jan 15 (1)

- Jan 14 (9)

- Jan 13 (8)

- Jan 12 (9)

- Jan 11 (8)

- Jan 10 (1)

- Jan 09 (2)

- Jan 08 (6)

- Jan 07 (8)

- Jan 06 (8)

- Jan 05 (9)

- Jan 04 (11)

-

►

December

(101)

-

►

2015

(1969)

-

►

December

(125)

- Dec 31 (1)

- Dec 27 (2)

- Dec 23 (1)

- Dec 22 (1)

- Dec 21 (7)

- Dec 18 (5)

- Dec 17 (7)

- Dec 16 (7)

- Dec 15 (7)

- Dec 14 (8)

- Dec 13 (1)

- Dec 11 (8)

- Dec 10 (7)

- Dec 09 (9)

- Dec 08 (7)

- Dec 07 (11)

- Dec 06 (1)

- Dec 04 (7)

- Dec 03 (11)

- Dec 02 (8)

- Dec 01 (9)

-

►

November

(170)

- Nov 30 (9)

- Nov 28 (8)

- Nov 27 (2)

- Nov 24 (6)

- Nov 23 (8)

- Nov 22 (3)

- Nov 21 (1)

- Nov 20 (4)

- Nov 19 (7)

- Nov 18 (9)

- Nov 17 (8)

- Nov 16 (9)

- Nov 15 (2)

- Nov 13 (6)

- Nov 12 (8)

- Nov 11 (7)

- Nov 10 (11)

- Nov 09 (10)

- Nov 08 (1)

- Nov 07 (3)

- Nov 06 (3)

- Nov 05 (10)

- Nov 04 (12)

- Nov 03 (11)

- Nov 02 (11)

- Nov 01 (1)

-

►

October

(163)

- Oct 31 (1)

- Oct 30 (11)

- Oct 29 (7)

- Oct 28 (9)

- Oct 27 (9)

- Oct 26 (10)

- Oct 25 (3)

- Oct 23 (3)

- Oct 22 (13)

- Oct 21 (9)

- Oct 20 (7)

- Oct 19 (6)

- Oct 18 (8)

- Oct 15 (7)

- Oct 14 (6)

- Oct 13 (5)

- Oct 12 (2)

- Oct 11 (2)

- Oct 10 (2)

- Oct 09 (2)

- Oct 08 (5)

- Oct 07 (10)

- Oct 06 (8)

- Oct 05 (6)

- Oct 04 (1)

- Oct 03 (1)

- Oct 02 (3)

- Oct 01 (7)

-

►

September

(163)

- Sep 30 (9)

- Sep 29 (5)

- Sep 28 (10)

- Sep 26 (3)

- Sep 25 (8)

- Sep 24 (8)

- Sep 23 (11)

- Sep 22 (7)

- Sep 21 (6)

- Sep 20 (2)

- Sep 18 (5)

- Sep 17 (8)

- Sep 16 (7)

- Sep 15 (9)

- Sep 14 (8)

- Sep 13 (2)

- Sep 12 (3)

- Sep 11 (2)

- Sep 10 (7)

- Sep 09 (8)

- Sep 08 (7)

- Sep 07 (5)

- Sep 04 (1)

- Sep 03 (8)

- Sep 02 (8)

- Sep 01 (6)

-

►

August

(142)

- Aug 31 (8)

- Aug 30 (6)

- Aug 27 (6)

- Aug 26 (7)

- Aug 25 (10)

- Aug 24 (5)

- Aug 23 (3)

- Aug 20 (6)

- Aug 19 (5)

- Aug 18 (7)

- Aug 17 (6)

- Aug 16 (4)

- Aug 14 (1)

- Aug 13 (8)

- Aug 12 (6)

- Aug 11 (6)

- Aug 10 (7)

- Aug 09 (6)

- Aug 06 (7)

- Aug 05 (9)

- Aug 04 (7)

- Aug 03 (12)

-

►

July

(156)

- Jul 31 (1)

- Jul 30 (9)

- Jul 29 (7)

- Jul 28 (5)

- Jul 27 (6)

- Jul 24 (5)

- Jul 23 (10)

- Jul 22 (12)

- Jul 21 (8)

- Jul 20 (7)

- Jul 19 (1)

- Jul 17 (5)

- Jul 16 (7)

- Jul 15 (8)

- Jul 14 (7)

- Jul 13 (10)

- Jul 12 (1)

- Jul 11 (3)

- Jul 10 (1)

- Jul 09 (8)

- Jul 08 (9)

- Jul 07 (7)

- Jul 06 (6)

- Jul 05 (4)

- Jul 04 (1)

- Jul 03 (2)

- Jul 02 (1)

- Jul 01 (5)

-

►

June

(172)

- Jun 30 (10)

- Jun 29 (10)

- Jun 28 (4)

- Jun 26 (3)

- Jun 25 (8)

- Jun 24 (8)

- Jun 23 (10)

- Jun 22 (9)

- Jun 21 (4)

- Jun 20 (1)

- Jun 18 (10)

- Jun 17 (5)

- Jun 16 (8)

- Jun 15 (6)

- Jun 14 (6)

- Jun 13 (2)

- Jun 11 (11)

- Jun 10 (7)

- Jun 09 (9)

- Jun 08 (7)

- Jun 07 (2)

- Jun 05 (4)

- Jun 04 (9)

- Jun 03 (7)

- Jun 02 (4)

- Jun 01 (8)

-

►

May

(167)

- May 29 (8)

- May 28 (10)

- May 27 (11)

- May 26 (8)

- May 21 (10)

- May 20 (12)

- May 19 (9)

- May 18 (7)

- May 17 (3)

- May 15 (3)

- May 14 (7)

- May 13 (8)

- May 12 (9)

- May 11 (9)

- May 10 (6)

- May 09 (2)

- May 07 (5)

- May 06 (7)

- May 05 (16)

- May 04 (10)

- May 03 (7)

-

►

April

(144)

- Apr 30 (6)

- Apr 29 (8)

- Apr 28 (10)

- Apr 27 (7)

- Apr 26 (5)

- Apr 24 (2)

- Apr 22 (8)

- Apr 21 (7)

- Apr 20 (8)

- Apr 19 (7)

- Apr 16 (7)

- Apr 15 (6)

- Apr 14 (10)

- Apr 13 (11)

- Apr 10 (1)

- Apr 09 (7)

- Apr 08 (7)

- Apr 07 (6)

- Apr 06 (6)

- Apr 02 (7)

- Apr 01 (8)

-

►

March

(200)

- Mar 31 (7)

- Mar 30 (9)

- Mar 29 (6)

- Mar 28 (1)

- Mar 27 (1)

- Mar 26 (5)

- Mar 25 (6)

- Mar 24 (8)

- Mar 23 (8)

- Mar 22 (8)

- Mar 19 (9)

- Mar 18 (10)

- Mar 17 (9)

- Mar 16 (10)

- Mar 14 (3)

- Mar 13 (3)

- Mar 12 (7)

- Mar 11 (8)

- Mar 10 (8)

- Mar 09 (9)

- Mar 08 (1)

- Mar 07 (8)

- Mar 05 (9)

- Mar 04 (11)

- Mar 03 (12)

- Mar 02 (9)

- Mar 01 (15)

-

►

February

(176)

- Feb 28 (2)

- Feb 27 (1)

- Feb 26 (11)

- Feb 25 (10)

- Feb 24 (10)

- Feb 23 (10)

- Feb 22 (9)

- Feb 19 (10)

- Feb 18 (10)

- Feb 17 (10)

- Feb 16 (9)

- Feb 12 (9)

- Feb 11 (10)

- Feb 10 (11)

- Feb 09 (7)

- Feb 08 (2)

- Feb 07 (2)

- Feb 06 (3)

- Feb 05 (11)

- Feb 04 (8)

- Feb 03 (9)

- Feb 02 (11)

- Feb 01 (1)

-

►

January

(191)

- Jan 30 (6)

- Jan 29 (12)

- Jan 28 (11)

- Jan 27 (11)

- Jan 26 (9)

- Jan 25 (2)

- Jan 24 (1)

- Jan 23 (5)

- Jan 22 (12)

- Jan 21 (7)

- Jan 20 (13)

- Jan 19 (10)

- Jan 15 (7)

- Jan 14 (10)

- Jan 13 (11)

- Jan 12 (12)

- Jan 11 (5)

- Jan 09 (2)

- Jan 08 (6)

- Jan 07 (14)

- Jan 06 (13)

- Jan 05 (7)

- Jan 04 (1)

- Jan 02 (1)

- Jan 01 (3)

-

►

December

(125)

-

►

2014

(2047)

-

►

December

(137)

- Dec 30 (2)

- Dec 24 (3)

- Dec 19 (1)

- Dec 18 (9)

- Dec 17 (8)

- Dec 16 (11)

- Dec 15 (10)

- Dec 14 (3)

- Dec 13 (2)

- Dec 12 (4)

- Dec 11 (10)

- Dec 10 (7)

- Dec 09 (9)

- Dec 08 (10)

- Dec 07 (3)

- Dec 06 (1)

- Dec 05 (6)

- Dec 04 (9)

- Dec 03 (10)

- Dec 02 (9)

- Dec 01 (10)

-

►

November

(162)

- Nov 29 (7)

- Nov 27 (3)

- Nov 26 (1)

- Nov 25 (10)

- Nov 24 (8)

- Nov 22 (8)

- Nov 20 (7)

- Nov 19 (12)

- Nov 18 (6)

- Nov 17 (10)

- Nov 16 (8)

- Nov 13 (10)

- Nov 12 (7)

- Nov 11 (10)

- Nov 10 (10)

- Nov 09 (5)

- Nov 07 (2)

- Nov 06 (10)

- Nov 05 (11)

- Nov 04 (8)

- Nov 03 (7)

- Nov 02 (1)

- Nov 01 (1)

-

►

October

(207)

- Oct 31 (7)

- Oct 30 (8)

- Oct 29 (10)

- Oct 28 (11)

- Oct 27 (10)

- Oct 25 (3)

- Oct 24 (9)

- Oct 23 (13)

- Oct 22 (10)

- Oct 21 (9)

- Oct 20 (9)

- Oct 19 (11)

- Oct 16 (11)

- Oct 15 (8)

- Oct 14 (9)

- Oct 13 (2)

- Oct 12 (5)

- Oct 09 (10)

- Oct 08 (11)

- Oct 07 (8)

- Oct 06 (8)

- Oct 05 (1)

- Oct 04 (4)

- Oct 03 (4)

- Oct 02 (8)

- Oct 01 (8)

-

►

September

(161)

- Sep 30 (10)

- Sep 29 (9)

- Sep 28 (4)

- Sep 26 (2)

- Sep 25 (7)

- Sep 24 (9)

- Sep 23 (8)

- Sep 22 (8)

- Sep 21 (3)

- Sep 20 (1)

- Sep 19 (2)

- Sep 18 (6)

- Sep 17 (10)

- Sep 16 (7)

- Sep 15 (8)

- Sep 14 (5)

- Sep 11 (7)

- Sep 10 (8)

- Sep 09 (8)

- Sep 08 (8)

- Sep 07 (1)

- Sep 06 (3)

- Sep 05 (3)

- Sep 04 (9)

- Sep 03 (7)

- Sep 02 (5)

- Sep 01 (3)

-

►

August

(130)

- Aug 28 (7)

- Aug 27 (7)

- Aug 26 (4)

- Aug 25 (6)

- Aug 24 (7)

- Aug 21 (7)

- Aug 20 (6)

- Aug 19 (6)

- Aug 18 (8)

- Aug 17 (6)

- Aug 14 (6)

- Aug 13 (6)

- Aug 12 (7)

- Aug 11 (6)

- Aug 10 (5)

- Aug 07 (7)

- Aug 06 (9)

- Aug 05 (8)

- Aug 04 (6)

- Aug 03 (1)

- Aug 02 (3)

- Aug 01 (2)

-

►

July

(184)

- Jul 31 (11)

- Jul 30 (9)

- Jul 29 (7)

- Jul 28 (10)

- Jul 27 (5)

- Jul 25 (2)

- Jul 24 (10)

- Jul 23 (10)

- Jul 22 (11)

- Jul 21 (7)

- Jul 20 (5)

- Jul 18 (1)

- Jul 17 (8)

- Jul 16 (8)

- Jul 15 (10)

- Jul 14 (7)

- Jul 13 (5)

- Jul 11 (1)

- Jul 10 (8)

- Jul 09 (8)

- Jul 08 (10)

- Jul 07 (7)

- Jul 06 (2)

- Jul 03 (7)

- Jul 02 (6)

- Jul 01 (9)

-

►

June

(176)

- Jun 30 (8)

- Jun 29 (4)

- Jun 28 (2)

- Jun 26 (7)

- Jun 25 (10)

- Jun 24 (9)

- Jun 23 (9)

- Jun 22 (2)

- Jun 20 (5)

- Jun 19 (8)

- Jun 18 (7)

- Jun 17 (8)

- Jun 16 (9)

- Jun 15 (3)

- Jun 13 (5)

- Jun 12 (8)

- Jun 11 (10)

- Jun 10 (8)

- Jun 09 (6)

- Jun 08 (3)

- Jun 06 (4)

- Jun 05 (10)

- Jun 04 (7)

- Jun 03 (8)

- Jun 02 (9)

- Jun 01 (7)

-

►

May

(152)

- May 29 (6)

- May 28 (11)

- May 27 (7)

- May 26 (8)

- May 22 (8)

- May 21 (10)

- May 20 (6)

- May 19 (8)

- May 18 (9)

- May 15 (7)

- May 14 (9)

- May 13 (9)

- May 12 (9)

- May 11 (1)

- May 10 (2)

- May 09 (4)

- May 08 (8)

- May 07 (8)

- May 06 (6)

- May 05 (6)

- May 04 (2)

- May 02 (1)

- May 01 (7)

-

►

April

(163)

- Apr 30 (10)

- Apr 29 (10)

- Apr 28 (8)

- Apr 27 (3)

- Apr 26 (4)

- Apr 25 (1)

- Apr 24 (7)

- Apr 23 (7)

- Apr 22 (5)

- Apr 21 (7)

- Apr 19 (5)

- Apr 18 (1)

- Apr 16 (9)

- Apr 15 (9)

- Apr 14 (7)

- Apr 13 (3)

- Apr 12 (2)

- Apr 11 (1)

- Apr 10 (7)

- Apr 09 (8)

- Apr 08 (10)

- Apr 07 (10)

- Apr 06 (1)

- Apr 03 (9)

- Apr 02 (8)

- Apr 01 (11)

-

►

March

(189)

- Mar 31 (12)

- Mar 30 (7)

- Mar 28 (2)

- Mar 27 (7)

- Mar 26 (12)

- Mar 25 (7)

- Mar 24 (6)

- Mar 23 (4)

- Mar 22 (1)

- Mar 21 (2)

- Mar 20 (6)

- Mar 19 (8)

- Mar 18 (7)

- Mar 17 (8)

- Mar 16 (4)

- Mar 14 (3)

- Mar 13 (6)

- Mar 12 (6)

- Mar 11 (10)

- Mar 10 (11)

- Mar 09 (3)

- Mar 08 (2)

- Mar 07 (3)

- Mar 06 (17)

- Mar 05 (5)

- Mar 04 (9)

- Mar 03 (9)

- Mar 02 (3)

- Mar 01 (9)

-

►

February

(182)

- Feb 27 (12)

- Feb 26 (9)

- Feb 25 (9)

- Feb 24 (9)

- Feb 23 (8)

- Feb 22 (5)

- Feb 21 (5)

- Feb 20 (7)

- Feb 19 (7)

- Feb 18 (7)

- Feb 17 (4)

- Feb 16 (1)

- Feb 15 (3)

- Feb 14 (4)

- Feb 13 (9)

- Feb 12 (9)

- Feb 11 (9)

- Feb 10 (8)

- Feb 09 (3)

- Feb 07 (4)

- Feb 06 (11)

- Feb 05 (9)

- Feb 04 (12)

- Feb 03 (10)

- Feb 02 (7)

- Feb 01 (1)

-

►

January

(204)

- Jan 31 (1)

- Jan 30 (12)

- Jan 29 (10)

- Jan 28 (10)

- Jan 27 (11)

- Jan 26 (4)

- Jan 25 (1)

- Jan 24 (8)

- Jan 23 (10)

- Jan 22 (11)

- Jan 21 (10)

- Jan 20 (9)

- Jan 19 (2)

- Jan 18 (1)

- Jan 16 (10)

- Jan 15 (10)

- Jan 14 (14)

- Jan 13 (13)

- Jan 12 (5)

- Jan 10 (2)

- Jan 09 (10)

- Jan 08 (13)

- Jan 07 (8)

- Jan 06 (13)

- Jan 05 (1)

- Jan 03 (4)

- Jan 02 (1)

-

►

December

(137)

-

►

2013

(2245)

-

►

December

(140)

- Dec 31 (1)

- Dec 30 (1)

- Dec 27 (1)

- Dec 24 (2)

- Dec 23 (2)

- Dec 19 (9)

- Dec 18 (9)

- Dec 17 (9)

- Dec 16 (11)

- Dec 15 (1)

- Dec 13 (7)

- Dec 12 (11)

- Dec 11 (9)

- Dec 10 (8)

- Dec 09 (8)

- Dec 08 (1)

- Dec 07 (3)

- Dec 06 (4)

- Dec 05 (11)

- Dec 04 (11)

- Dec 03 (14)

- Dec 02 (7)

-

►

November

(166)

- Nov 28 (4)

- Nov 27 (4)

- Nov 26 (11)

- Nov 25 (6)

- Nov 24 (6)

- Nov 22 (3)

- Nov 21 (8)

- Nov 20 (9)

- Nov 19 (12)

- Nov 18 (10)

- Nov 17 (7)

- Nov 14 (10)

- Nov 13 (6)

- Nov 12 (9)

- Nov 11 (11)

- Nov 10 (3)

- Nov 09 (1)

- Nov 08 (3)

- Nov 07 (9)

- Nov 06 (7)

- Nov 05 (9)

- Nov 04 (11)

- Nov 03 (6)

- Nov 01 (1)

-

►

October

(189)

- Oct 31 (7)

- Oct 30 (9)

- Oct 29 (9)

- Oct 28 (8)

- Oct 27 (4)

- Oct 25 (2)

- Oct 24 (6)

- Oct 23 (12)

- Oct 22 (8)

- Oct 21 (9)

- Oct 20 (2)

- Oct 19 (1)

- Oct 18 (5)

- Oct 17 (8)

- Oct 16 (9)

- Oct 15 (10)

- Oct 14 (6)

- Oct 13 (1)

- Oct 11 (2)

- Oct 10 (10)

- Oct 09 (12)

- Oct 08 (7)

- Oct 07 (10)

- Oct 06 (5)

- Oct 04 (2)

- Oct 03 (8)

- Oct 02 (10)

- Oct 01 (7)

-

►

September

(187)

- Sep 30 (9)

- Sep 28 (8)

- Sep 26 (8)

- Sep 25 (6)

- Sep 24 (10)

- Sep 23 (9)

- Sep 22 (1)

- Sep 20 (6)

- Sep 19 (9)

- Sep 18 (8)

- Sep 17 (12)

- Sep 16 (11)

- Sep 15 (10)

- Sep 12 (12)

- Sep 11 (9)

- Sep 10 (11)

- Sep 09 (10)

- Sep 08 (8)

- Sep 05 (8)

- Sep 04 (10)

- Sep 03 (6)

- Sep 02 (6)

-

►

August

(183)

- Aug 29 (8)

- Aug 28 (11)

- Aug 27 (10)

- Aug 26 (9)

- Aug 25 (5)

- Aug 24 (1)

- Aug 23 (3)

- Aug 22 (9)

- Aug 21 (8)

- Aug 20 (11)

- Aug 19 (8)

- Aug 18 (4)

- Aug 15 (10)

- Aug 14 (9)

- Aug 13 (8)

- Aug 12 (9)

- Aug 10 (4)

- Aug 09 (3)

- Aug 08 (9)

- Aug 07 (9)

- Aug 06 (10)

- Aug 05 (8)

- Aug 02 (8)

- Aug 01 (9)

-

►

July

(183)

- Jul 31 (7)

- Jul 30 (11)

- Jul 29 (7)

- Jul 28 (2)

- Jul 26 (5)

- Jul 25 (12)

- Jul 24 (10)

- Jul 23 (10)

- Jul 22 (7)

- Jul 21 (5)

- Jul 20 (1)

- Jul 19 (2)

- Jul 18 (6)

- Jul 17 (11)

- Jul 16 (7)

- Jul 15 (10)

- Jul 14 (3)

- Jul 13 (2)

- Jul 12 (2)

- Jul 11 (9)

- Jul 10 (10)

- Jul 09 (13)

- Jul 08 (10)

- Jul 05 (7)

- Jul 02 (6)

- Jul 01 (8)

-

►

June

(185)

- Jun 30 (1)

- Jun 28 (6)

- Jun 27 (12)

- Jun 26 (7)

- Jun 25 (12)

- Jun 24 (11)

- Jun 21 (7)

- Jun 20 (12)

- Jun 19 (11)

- Jun 18 (13)

- Jun 17 (11)

- Jun 16 (1)

- Jun 15 (2)

- Jun 14 (3)

- Jun 13 (8)

- Jun 12 (8)

- Jun 11 (9)

- Jun 10 (6)

- Jun 09 (3)

- Jun 08 (1)

- Jun 07 (3)

- Jun 06 (9)

- Jun 05 (9)

- Jun 04 (10)

- Jun 03 (7)

- Jun 01 (3)

-

►

May

(204)

- May 31 (2)

- May 30 (10)

- May 29 (10)

- May 28 (10)

- May 27 (3)

- May 24 (5)

- May 23 (9)

- May 22 (8)

- May 21 (14)

- May 20 (13)

- May 19 (8)

- May 16 (8)

- May 15 (10)

- May 14 (11)

- May 13 (9)

- May 12 (9)

- May 09 (11)

- May 08 (11)

- May 07 (10)

- May 06 (9)

- May 05 (5)

- May 02 (9)

- May 01 (10)

-

►

April

(188)

- Apr 30 (9)

- Apr 29 (10)

- Apr 28 (3)

- Apr 26 (4)

- Apr 25 (9)

- Apr 24 (13)

- Apr 23 (10)

- Apr 22 (7)

- Apr 21 (3)

- Apr 20 (4)

- Apr 19 (1)

- Apr 18 (7)

- Apr 17 (11)

- Apr 16 (1)

- Apr 15 (10)

- Apr 14 (3)

- Apr 12 (7)

- Apr 11 (8)

- Apr 10 (8)

- Apr 09 (10)

- Apr 08 (12)

- Apr 07 (10)

- Apr 04 (7)

- Apr 03 (7)

- Apr 02 (8)

- Apr 01 (6)

-

►

March

(201)

- Mar 30 (1)

- Mar 29 (3)

- Mar 28 (10)

- Mar 27 (10)

- Mar 26 (11)

- Mar 25 (7)

- Mar 24 (3)

- Mar 23 (3)

- Mar 22 (1)

- Mar 21 (8)

- Mar 20 (13)

- Mar 19 (11)

- Mar 18 (10)

- Mar 17 (9)

- Mar 14 (10)

- Mar 13 (14)

- Mar 12 (9)

- Mar 11 (11)

- Mar 10 (3)

- Mar 08 (5)

- Mar 07 (9)

- Mar 06 (8)

- Mar 05 (12)

- Mar 04 (10)

- Mar 03 (9)

- Mar 01 (1)

-

►

February

(191)

- Feb 28 (10)

- Feb 27 (10)

- Feb 26 (9)

- Feb 25 (10)

- Feb 24 (10)

- Feb 22 (2)

- Feb 21 (10)

- Feb 20 (15)

- Feb 19 (12)

- Feb 18 (9)

- Feb 16 (1)

- Feb 14 (9)

- Feb 13 (9)

- Feb 12 (12)

- Feb 11 (7)

- Feb 10 (3)

- Feb 09 (1)

- Feb 08 (3)

- Feb 07 (7)

- Feb 06 (13)

- Feb 05 (9)

- Feb 04 (12)

- Feb 03 (2)

- Feb 02 (3)

- Feb 01 (3)

-

►

January

(228)

- Jan 31 (13)

- Jan 30 (11)

- Jan 29 (11)

- Jan 28 (11)

- Jan 27 (1)

- Jan 26 (1)

- Jan 25 (5)

- Jan 24 (12)

- Jan 23 (13)

- Jan 22 (14)

- Jan 21 (6)

- Jan 18 (5)

- Jan 17 (9)

- Jan 16 (9)

- Jan 15 (10)

- Jan 14 (13)

- Jan 13 (7)

- Jan 10 (12)

- Jan 09 (12)

- Jan 08 (11)

- Jan 07 (12)

- Jan 06 (7)

- Jan 05 (5)

- Jan 03 (7)

- Jan 02 (10)

- Jan 01 (1)

-

►

December

(140)

-

►

2012

(2360)

-

►

December

(132)

- Dec 20 (8)

- Dec 19 (10)

- Dec 18 (9)

- Dec 17 (10)

- Dec 16 (2)

- Dec 15 (2)

- Dec 14 (4)

- Dec 13 (11)

- Dec 12 (10)

- Dec 11 (9)

- Dec 10 (8)

- Dec 09 (6)

- Dec 07 (1)

- Dec 06 (9)

- Dec 05 (9)

- Dec 04 (9)

- Dec 03 (9)

- Dec 02 (5)

- Dec 01 (1)

-

►

November

(162)

- Nov 30 (3)

- Nov 29 (9)

- Nov 28 (9)

- Nov 27 (9)

- Nov 26 (10)

- Nov 25 (10)

- Nov 20 (10)

- Nov 19 (9)

- Nov 18 (3)

- Nov 17 (5)

- Nov 16 (3)

- Nov 15 (7)

- Nov 14 (9)

- Nov 13 (9)

- Nov 12 (7)

- Nov 09 (2)

- Nov 08 (8)

- Nov 07 (8)

- Nov 06 (7)

- Nov 05 (8)

- Nov 04 (4)

- Nov 02 (2)

- Nov 01 (11)

-

►

October

(212)

- Oct 31 (11)

- Oct 30 (9)

- Oct 29 (9)

- Oct 28 (3)

- Oct 26 (4)

- Oct 25 (9)

- Oct 24 (8)

- Oct 23 (10)

- Oct 22 (11)

- Oct 21 (1)

- Oct 20 (2)

- Oct 19 (6)

- Oct 18 (10)

- Oct 17 (11)

- Oct 16 (14)

- Oct 15 (8)

- Oct 14 (6)

- Oct 13 (1)

- Oct 12 (2)

- Oct 11 (8)

- Oct 10 (13)

- Oct 09 (9)

- Oct 08 (8)

- Oct 07 (1)

- Oct 05 (6)

- Oct 04 (7)

- Oct 03 (5)

- Oct 02 (8)

- Oct 01 (12)

-

►

September

(174)

- Sep 30 (1)

- Sep 29 (2)

- Sep 28 (9)

- Sep 27 (7)

- Sep 26 (8)

- Sep 25 (9)

- Sep 24 (8)

- Sep 23 (4)

- Sep 21 (2)

- Sep 20 (7)

- Sep 19 (9)

- Sep 18 (12)

- Sep 17 (13)

- Sep 16 (5)

- Sep 15 (1)

- Sep 14 (1)

- Sep 13 (10)

- Sep 12 (7)

- Sep 11 (9)

- Sep 10 (7)

- Sep 09 (4)

- Sep 08 (1)

- Sep 07 (3)

- Sep 06 (7)

- Sep 05 (11)

- Sep 04 (10)

- Sep 03 (6)

- Sep 01 (1)

-

►

August

(183)

- Aug 31 (1)

- Aug 30 (8)

- Aug 29 (10)

- Aug 28 (7)

- Aug 27 (8)

- Aug 26 (4)

- Aug 25 (1)

- Aug 24 (5)

- Aug 23 (3)

- Aug 22 (9)

- Aug 21 (9)

- Aug 20 (8)

- Aug 19 (6)

- Aug 18 (2)

- Aug 16 (7)

- Aug 15 (9)

- Aug 14 (8)

- Aug 13 (4)

- Aug 12 (4)

- Aug 10 (1)

- Aug 09 (14)

- Aug 08 (7)

- Aug 07 (10)

- Aug 06 (12)

- Aug 05 (2)

- Aug 03 (7)

- Aug 02 (8)

- Aug 01 (9)

-

►

July

(173)

- Jul 31 (11)

- Jul 26 (9)

- Jul 25 (13)

- Jul 24 (9)

- Jul 23 (23)

- Jul 22 (9)

- Jul 19 (9)

- Jul 18 (8)

- Jul 16 (7)

- Jul 15 (3)

- Jul 14 (2)

- Jul 13 (2)

- Jul 12 (6)

- Jul 11 (17)

- Jul 10 (13)

- Jul 09 (7)

- Jul 06 (6)

- Jul 05 (4)

- Jul 03 (1)

- Jul 02 (14)

-

►

June

(397)

- Jun 29 (7)

- Jun 28 (3)

- Jun 27 (20)

- Jun 26 (28)

- Jun 25 (36)

- Jun 24 (21)

- Jun 21 (15)

- Jun 20 (16)

- Jun 19 (18)

- Jun 18 (21)

- Jun 17 (20)

- Jun 14 (19)

- Jun 13 (19)

- Jun 12 (23)

- Jun 11 (20)

- Jun 10 (28)

- Jun 09 (4)

- Jun 08 (1)

- Jun 07 (12)

- Jun 06 (9)

- Jun 05 (20)

- Jun 04 (18)

- Jun 03 (19)

-

►

May

(88)

- May 30 (5)

- May 29 (3)

- May 28 (2)

- May 25 (1)

- May 24 (5)

- May 23 (4)

- May 22 (6)

- May 21 (3)

- May 20 (1)

- May 18 (15)

- May 17 (12)

- May 16 (2)

- May 15 (6)

- May 14 (8)

- May 11 (3)

- May 10 (6)

- May 09 (4)

- May 08 (2)

-

►

April

(218)

- Apr 29 (11)

- Apr 26 (7)

- Apr 25 (11)

- Apr 24 (11)

- Apr 23 (14)

- Apr 22 (12)

- Apr 19 (15)

- Apr 18 (13)

- Apr 17 (11)

- Apr 16 (9)

- Apr 15 (12)

- Apr 12 (4)

- Apr 11 (11)

- Apr 10 (9)

- Apr 09 (14)

- Apr 08 (10)

- Apr 05 (10)

- Apr 03 (9)

- Apr 02 (10)

- Apr 01 (15)

-

►

March

(191)

- Mar 29 (10)

- Mar 28 (6)

- Mar 27 (9)

- Mar 26 (13)

- Mar 25 (11)

- Mar 22 (9)

- Mar 21 (7)

- Mar 20 (12)

- Mar 19 (9)

- Mar 18 (11)

- Mar 15 (8)

- Mar 14 (8)

- Mar 13 (7)

- Mar 12 (9)

- Mar 11 (12)

- Mar 08 (7)

- Mar 07 (7)

- Mar 06 (6)

- Mar 05 (8)

- Mar 04 (14)

- Mar 01 (8)

-

►

December

(132)

-

►

2011

(2796)

-

►

December

(258)

- Dec 31 (1)

- Dec 27 (5)

- Dec 26 (1)

- Dec 22 (2)

- Dec 21 (1)

- Dec 20 (16)

- Dec 19 (25)

- Dec 18 (18)

- Dec 15 (12)

- Dec 14 (14)

- Dec 13 (20)

- Dec 12 (14)

- Dec 11 (25)

- Dec 08 (20)

- Dec 07 (21)

- Dec 06 (19)

- Dec 05 (22)

- Dec 04 (11)

- Dec 01 (11)

-

►

November

(269)

- Nov 30 (21)

- Nov 29 (15)

- Nov 28 (18)

- Nov 27 (13)

- Nov 24 (11)

- Nov 23 (2)

- Nov 22 (1)

- Nov 21 (9)

- Nov 20 (18)

- Nov 17 (19)

- Nov 16 (17)

- Nov 15 (16)

- Nov 14 (12)

- Nov 13 (13)

- Nov 09 (10)

- Nov 08 (16)

- Nov 07 (10)

- Nov 06 (11)

- Nov 04 (1)

- Nov 03 (10)

- Nov 02 (7)

- Nov 01 (19)

-

►

October

(235)

- Oct 31 (11)

- Oct 30 (22)

- Oct 27 (8)

- Oct 26 (11)

- Oct 25 (14)

- Oct 24 (9)

- Oct 23 (9)

- Oct 22 (1)

- Oct 20 (4)

- Oct 19 (12)

- Oct 18 (10)

- Oct 17 (14)

- Oct 16 (9)

- Oct 14 (3)

- Oct 13 (6)

- Oct 12 (4)

- Oct 11 (13)

- Oct 10 (14)

- Oct 09 (15)

- Oct 06 (9)

- Oct 05 (8)

- Oct 04 (7)

- Oct 03 (10)

- Oct 02 (12)

-

►

September

(191)

- Sep 29 (7)

- Sep 28 (11)

- Sep 27 (8)

- Sep 26 (10)

- Sep 25 (13)

- Sep 24 (1)

- Sep 22 (10)

- Sep 21 (6)

- Sep 20 (15)

- Sep 19 (13)

- Sep 18 (11)

- Sep 17 (6)

- Sep 14 (9)

- Sep 13 (7)

- Sep 12 (10)

- Sep 11 (10)

- Sep 08 (8)

- Sep 07 (7)

- Sep 06 (11)

- Sep 05 (11)

- Sep 04 (6)

- Sep 01 (1)

-

►

August

(217)

- Aug 31 (8)

- Aug 30 (9)

- Aug 29 (9)

- Aug 28 (9)

- Aug 25 (1)

- Aug 24 (16)

- Aug 23 (11)

- Aug 22 (13)

- Aug 21 (11)

- Aug 20 (1)

- Aug 19 (1)

- Aug 18 (2)

- Aug 17 (9)

- Aug 16 (10)

- Aug 15 (13)

- Aug 14 (11)

- Aug 11 (2)

- Aug 10 (13)

- Aug 09 (7)

- Aug 08 (9)

- Aug 07 (12)

- Aug 06 (1)

- Aug 05 (1)

- Aug 04 (5)

- Aug 03 (12)

- Aug 02 (9)

- Aug 01 (12)

-

►

July

(223)

- Jul 31 (14)

- Jul 28 (8)

- Jul 27 (12)

- Jul 26 (15)

- Jul 25 (11)

- Jul 24 (15)

- Jul 21 (2)

- Jul 20 (16)

- Jul 19 (10)

- Jul 18 (14)

- Jul 17 (11)

- Jul 16 (1)

- Jul 15 (1)

- Jul 14 (4)

- Jul 13 (16)

- Jul 12 (8)

- Jul 11 (13)

- Jul 10 (15)

- Jul 07 (9)

- Jul 06 (8)

- Jul 05 (9)

- Jul 04 (9)

- Jul 03 (1)

- Jul 01 (1)

-

►

June

(240)

- Jun 30 (10)

- Jun 29 (13)

- Jun 28 (11)

- Jun 27 (12)

- Jun 26 (7)

- Jun 25 (1)

- Jun 23 (14)

- Jun 22 (10)

- Jun 21 (10)

- Jun 20 (13)

- Jun 19 (9)

- Jun 18 (1)

- Jun 16 (10)

- Jun 15 (12)

- Jun 14 (18)

- Jun 13 (11)

- Jun 12 (12)

- Jun 09 (10)

- Jun 08 (11)

- Jun 07 (14)

- Jun 06 (8)

- Jun 05 (10)

- Jun 02 (4)

- Jun 01 (9)

-

►

May

(230)

- May 31 (13)

- May 30 (15)

- May 29 (6)

- May 26 (1)

- May 25 (9)

- May 24 (8)

- May 23 (10)

- May 22 (14)

- May 19 (8)

- May 18 (10)

- May 17 (8)

- May 16 (11)

- May 15 (8)

- May 12 (7)

- May 11 (8)

- May 10 (11)

- May 09 (12)

- May 08 (16)

- May 07 (1)

- May 05 (6)

- May 04 (14)

- May 03 (12)

- May 02 (11)

- May 01 (11)

-

►

April

(216)

- Apr 28 (4)

- Apr 27 (12)

- Apr 26 (20)

- Apr 25 (9)

- Apr 24 (11)

- Apr 21 (2)

- Apr 20 (10)

- Apr 19 (11)

- Apr 18 (14)

- Apr 17 (13)

- Apr 14 (8)

- Apr 13 (12)

- Apr 12 (12)

- Apr 11 (9)

- Apr 10 (14)

- Apr 07 (6)

- Apr 06 (11)

- Apr 05 (13)

- Apr 04 (11)

- Apr 03 (12)

- Apr 02 (1)

- Apr 01 (1)

-

►

March

(252)

- Mar 31 (7)

- Mar 30 (15)

- Mar 29 (5)

- Mar 28 (14)

- Mar 27 (17)

- Mar 26 (1)

- Mar 24 (1)

- Mar 23 (11)

- Mar 22 (13)

- Mar 21 (12)

- Mar 20 (12)

- Mar 19 (2)

- Mar 17 (5)

- Mar 16 (9)

- Mar 15 (9)

- Mar 14 (14)

- Mar 13 (11)

- Mar 12 (1)

- Mar 11 (1)

- Mar 10 (9)