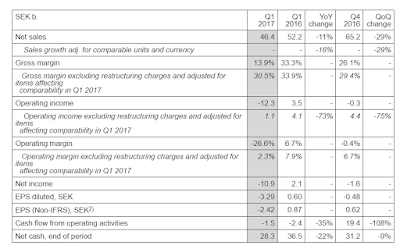

Ericsson reported Q1 2017 sales of 46.4 billion, down by -11% compared to year earlier due to lower mobile infrastructure investments in certain markets,lower IPR licensing revenues and the renewed managed services contract with reduced scope in North America. Operating income was SEK -12.3 b., after provisions, write-downs and restructuring charges of SEK -13.4 b. Excluding these items the operating income amounted to SEK 1.1 b.

"Our performance in the first quarter continued to be unsatisfactory," stated Ericsson CEO Börje Ekholm. "The immediate priority is to improve profitability while also taking action to revitalize technology and market leadership...We are not satisfied with the cost structure of the company and the existing cost and efficiency program is not yielding sufficient results. Based on current profitability, we will intensify our efforts to reduce cost with focus on structural changes to generate lasting efficiency gains and increase cost competitiveness. Our target is to surpass previous ambitions. However, we need to increase investment in certain core areas to develop our product portfolio, which can temporarily increase cost levels."

Some highlights:

- Despite lower sales, Networks delivered a solid result. The new Ericsson Radio System platform contributed to improving profitability and stabilizing the market share position, after several years of decline.

- The concerning developments in IT & Cloud continued with significantly increased losses.

- Ericsson is seeking alternatives for its IT cloud infrastructure hardware business.

- The accelerated losses in Media were caused by a faster than anticipated decline in legacy product sales, not offset by growth in the new portfolio. Ericsson is exploring strategic opportunities for Media.

https://www.ericsson.com/news/2098356