Microsoft reported Q3 revenue of $50.1 billion up 11% (up 16% in constant currency) compared to last year. Net income was $17.6 billion, a drop of 14% (down 8% in constant currency).

“In a world facing increasing headwinds, digital technology is the ultimate tailwind,” said Satya Nadella, chairman and chief executive officer of Microsoft. “In this environment, we’re focused on helping our customers do more with less, while investing in secular growth areas and managing our cost structure in a disciplined way."

“This quarter Microsoft Cloud revenue was $25.7 billion, up 24% (up 31% in constant currency) year-over-year. We continue to see healthy demand across our commercial businesses including another quarter of solid bookings as we deliver compelling value for customers,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

Highlights

- Revenue in Productivity and Business Processes was $16.5 billion and increased 9% (up 15% in constant currency), with the following business highlights:

- Office Commercial products and cloud services revenue increased 7% (up 13% in constant currency) driven by Office 365 Commercial revenue growth of 11% (up 17% in constant currency)

- Office Consumer products and cloud services revenue increased 7% (up 11% in constant currency) and Microsoft 365 Consumer subscribers grew to 61.3 million

- LinkedIn revenue increased 17% (up 21% in constant currency)

- Dynamics products and cloud services revenue increased 15% (up 22% in constant currency) driven by Dynamics 365 revenue growth of 24% (up 32% in constant currency)

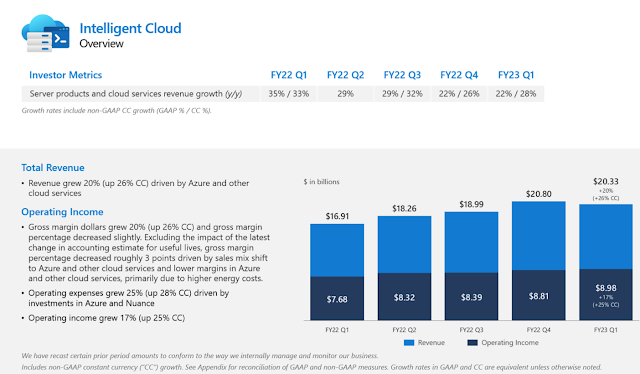

Revenue in Intelligent Cloud was $20.3 billion and increased 20% (up 26% in constant currency), with the following business highlights:

- Server products and cloud services revenue increased 22% (up 28% in constant currency) driven by Azure and other cloud services revenue growth of 35% (up 42% in constant currency)

Revenue in More Personal Computing was $13.3 billion and decreased slightly (up 3% in constant currency), with the following business highlights:

- Windows OEM revenue decreased 15%

- Windows Commercial products and cloud services revenue increased 8% (up 15% in constant currency)

- Xbox content and services revenue decreased 3% (up 1% in constant currency)

- Search and news advertising revenue excluding traffic acquisition costs increased 16% (up 21% in constant currency)

- Devices revenue increased 2% (up 8% in constant currency)