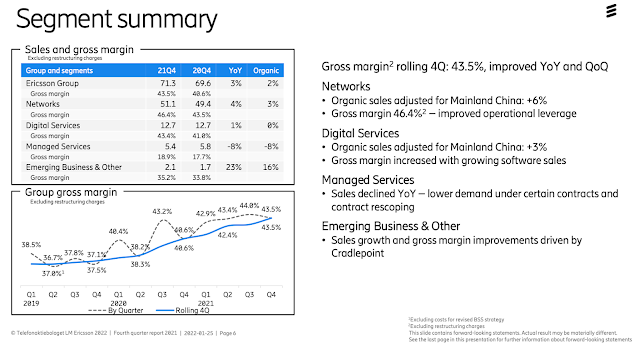

Ericsson reported steady sales in its core mobile infrastructure business for Q4 2021 despite a significant drop off in business in mainland China. Overall group organic sales for Q4 2022 grew by 2% YoY. Excluding mainland China, organic sales growth was 5%. Reported sales were SEK 71.3 (69.6) billion (approximately US$7.7 billion).

In North America, Europe and Latin America, Ericsson saw strong growth in 5G. Business in South East Asia, Oceania and India declined due to timing of orders and project milestones.

Gross margin improved in all segments to 43.5% (40.6%) excluding restructuring charges. Reported gross margin was 43.2% (40.6%).

For the full year 2021, group organic sales grew by 4%, with an increase in Networks sales of 7%. Reported sales were stable at SEK 232.3 b. The loss of market share in Mainland China impacted sales by SEK -7.7 b. and the growth rate by -3 percentage points, meaning that excluding Mainland China, organic sales growth was 8%.

Some comments from Börje Ekholm, President and CEO of Ericsson:

"Our strategy to invest in technology leadership and grow market share in our core business underpinned a robust financial performance in 2021 and ensured a good Q4 for Ericsson overall. Our commitment to pursue value from growth in wireless enterprise took a significant step forward with the announcement of our ambition to acquire Vonage, which will give us the foundation to develop a Global Network Platform to drive innovation on top of the 5G networks. This adds to already strong progress in 2021 in our organic enterprise portfolio - Dedicated Networks and IoT - and follows the successful integration of Cradlepoint. With a full-year EBIT margin of 13.9%, we reached our 2022 target one year early, while absorbing significantly increased investments in R&D, Enterprise, cybersecurity and compliance."

"Based on current business momentum, we expect fundamentals to remain strong in our core mobile infrastructure business during 2022. We will continue to increase investments in R&D to sustain our technology leadership and strengthen our competitive position to take advantage of the rollout of 5G networks. At the same time, we will continue our efforts to expand our presence in the enterprise market. Over time, we expect the enterprise segment to provide higher growth and profitability than our mobile infrastructure business."