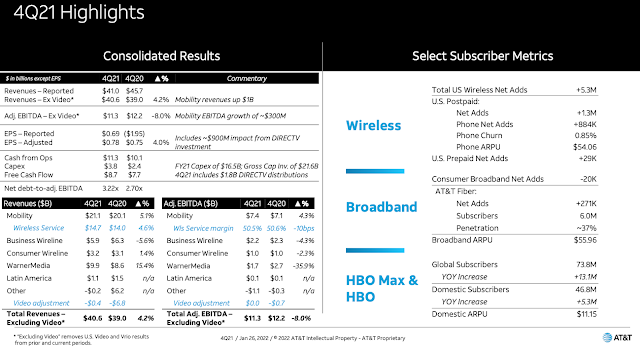

Citing customer growth in wireless, fiber and HBO Max, AT&T reported consolidated revenues for Q4 2021 of $41.0 billion versus $45.7 billion in the year-ago quarter, down 10.4% reflecting the impact of divested businesses, mainly U.S. Video in the third quarter and Vrio in the fourth quarter, and lower Business Wireline revenues. Excluding impacts of the U.S. Video business and Vrio from both quarters, consolidated revenues totaled $40.6 billion9 compared to $39.0 billion in the year-ago quarter.

For full-year 2021 when compared with 2020 results, AT&T's consolidated revenues totaled $168.9 billion versus $171.8 billion, reflecting the separation of the U.S. Video business in the third quarter of 2021, and the impacts from other divested businesses. These decreases were partially offset by higher revenues in WarnerMedia and Communications. Excluding impacts of U.S. Video and Vrio from both years, consolidated revenues totaled $153.2 billion9 compared to $144.6 billion in 2020.

“A year and a half ago, we began simplifying our business to reposition AT&T for growth and we’re extremely pleased with how we’ve executed on that commitment,” said John Stankey, AT&T CEO. “We ended 2021 the way we started it – by growing our customer relationships, running our operations more effectively and efficiently, and sharpening our focus. Our momentum is strong and we’re confident there is more opportunity to continue to grow our customer base and drive costs from the business.

“We’re at the dawn of a new age of connectivity. Our focus now is to be America’s best connectivity provider and also ensure our media assets are positioned to grow and truly become a global media distribution leader. Once we do this, we’ll unlock the true value of these businesses and provide a great opportunity for shareholders.”

Some highlights for Communications:

Fourth-quarter revenues were $30.2 billion, up 2.4% year over year due to increases in Mobility and Consumer Wireline more than offsetting a decline in Business Wireline. Operating contribution was $6.5 billion, up 1.4% year over year, with operating income margin of 21.4%, compared to 21.6% in the year-ago quarter.

Mobility

- Revenues were up 5.1% year over year to $21.1 billion due to higher service and equipment revenues. Service revenues were $14.7 billion, up 4.6% year over year due to subscriber gains and the lapping of pandemic impacts on international roaming revenues. Equipment revenues were $6.5 billion, up 6.2% year over year, driven by increased sales of higher-priced smartphones.

- Operating expenses were $15.8 billion, up 5.1% year over year due to higher equipment costs, including 3G network shutdown costs of approximately $130 million, and higher HBO Max bundling costs, partially offset by lower marketing and support.

- Total net adds were 5.3 million including 1,285,000 postpaid net adds and 24,000 prepaid phone net adds

- Postpaid churn was 1.02% versus 0.94% in the year-ago quarter. Postpaid phone churn was 0.85% versus 0.76% in the year-ago quarter. Prepaid phone churn was less than 3% with Cricket substantially lower.

- Postpaid phone-only ARPU was $54.06, down 0.7% versus the year-ago quarter, due to the impacts of promotional discount amortization.

Business Wireline

- Revenues were $5.9 billion, down 5.6% year over year, partially due to the prior-year increase for pandemic-related connectivity, lower demand for legacy voice and data services, and a strategic decision to deemphasize non-core services.

- More than 675,000 U.S. business buildings are lit with fiber from AT&T, enabling high-speed fiber connections to more than 2.75 million U.S. business customer locations. Nationwide, more than 9.5 million business customer locations are on or within 1,000 feet of AT&T fiber.

Consumer Wireline

- Revenues were $3.2 billion, up 1.4% year over year due to gains in broadband more than offsetting declines in legacy voice and data services and other services. Broadband revenues increased 5.4%, which reflects fiber subscriber growth and higher ARPU resulting from increases in higher-revenue fiber customers.

- Total broadband and DSL subscriber net losses were 20,000, reflecting growth in fiber subscribers mostly offsetting losses in slower-speed services.

- Full-year 2021 fiber net adds totaled about 1.0 million, the fourth consecutive year in which the company added 1 million or more fiber subscribers. AT&T Fiber is marketed to about 16 million customer locations.

https://investors.att.com/financial-reports/quarterly-earnings/2021