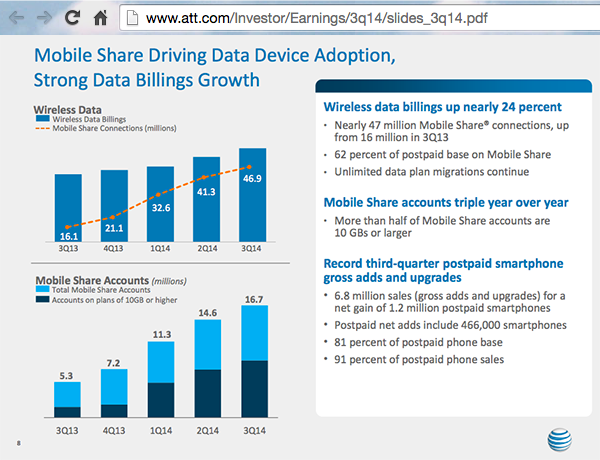

AT&T added 2 million wireless users in Q3 while making progress in migrating its existing customer base onto Mobile Share plans and away from unlimited data plans. About 62% of the postpaid customers are now on Mobile Share plans, with more than half on plans sharing 10GB of wireless data per month with family members. The company said its wireless margins have been impacted by strong adoption of Mobile Share Value plans, but that customer satisfaction is increasing.

For the quarter, AT&T reported consolidated revenues of $33.0 billion, up 2.5 percent versus the year-earlier period. Compared with results for the third quarter of 2013, operating expenses were $27.6 billion versus $26.0 billion; operating income was $5.4 billion versus $6.2 billion; and operating income margin was 16.4 percent versus 19.2 percent.

“Our strategy is on track and our investments in giving customers best-in-class service to access content everywhere and on any screen continue to pay off,” said Randall Stephenson, AT&T chairman and CEO. “We had strong subscriber growth in wireless and U-verse, and our strategic business services revenues continued to post double-digit growth.”

“Our strategy is on track and our investments in giving customers best-in-class service to access content everywhere and on any screen continue to pay off,” said Randall Stephenson, AT&T chairman and CEO. “We had strong subscriber growth in wireless and U-verse, and our strategic business services revenues continued to post double-digit growth.”

Some operational highlights

- Total wireless revenues, which include equipment sales, were up 4.9 percent year over year to $18.3 billion.

- Wireless service revenues were essentially flat in the third quarter at $15.4 billion, and wireless equipment revenues increased 44.3 percent to $2.9 billion as more customers chose equipment installment plans versus subsidized devices.

- There was a year-over-year reduction in postpaid service ARPU (average revenues per user); however, ARPU improved when compared to the second quarter of 2014.

- Phone-only postpaid ARPU decreased 8.0 percent versus the year-earlier

- There was a third-quarter net increase in total wireless subscribers of 2 million, led by gains in postpaid and connected devices. The company added 785,000 postpaid subscribers, more than twice as many as in the year-ago third quarter.

- Postpaid net adds include 466,000 smartphones. Total branded smartphone net adds (both postpaid and prepaid) were 530,000, including expected declines in legacy Cricket smartphone subscribers. Total branded tablet net adds were 342,000. The company had 434,000 postpaid tablet net adds.

- At the end of the quarter, 81 percent, or 55.8 million, of AT&T's postpaid phone subscribers had smartphones, up from 75 percent, or 50.6 million, a year earlier.

- At the end of the third quarter, 67 percent of AT&T’s postpaid smartphone customers had an LTE-capable device.

- The company had a third-quarter record 6.8 million postpaid smartphone gross adds and upgrades.

- The company also had a record number of customers who brought their own devices — more than 460,000 of postpaid smartphone gross adds.

- Total third-quarter wireline revenues were $14.6 billion, down 0.4 percent versus the year-earlier quarter and down slightly versus the second quarter of 2014.

- Total U-verse revenues grew 23.8 percent year over year. T

- hird-quarter wireline operating expenses were $13.3 billion, up 1.6 percent versus the third quarter of 2013.

- AT&T’s wireline operating income totaled $1.3 billion, down 17.2 percent versus the third quarter of 2013. T

- Revenues from residential customers totaled $5.7 billion, an increase of 3.0 percent versus the third quarter a year ago.

- U-verse, which includes high speed Internet, TV and Voice over IP, now represents 64 percent of wireline consumer revenues, up from 54 percent in the year-earlier quarter. Consumer U-verse revenues grew 23.2 percent year over year.

- U-verse high speed Internet had a third-quarter net gain of 601,000 subscribers, to reach a total of 12.1 million.

- Total revenues from business customers were $8.7 billion, down 2.0 percent versus the year-earlier quarter but stable sequentially.

- Overall, declines in legacy products were partially offset by continued double-digit growth in strategic business services. Revenues from these services, the next-generation capabilities that lead AT&T's most advanced business solutions — including VPNs, Ethernet, cloud, hosting, IP conferencing, VoIP, MIS over Ethernet, U-verse and security services — grew 14.3 percent versus the year-earlier quarter.

- These services represent an annualized revenue stream of nearly $10 billion and are more than 28 percent of wireline business revenues in the third quarter.

http://about.att.com/story/att_third_quarter_earnings_2014.html