Alcatel-Lucent's group revenues, excluding Managed Services, were down 3.8% year-on-year to Euro 3.254 billion, and down 5.9% overall. Gross margin reached 34.0% of revenues in the quarter, progressing by 210 basis points year-on-year driven by better profitability in several business lines as well as favorable mix. Fixed costs savings amounted to Euro 73 million in Q3 2014, bringing cumulative fixed cost savings to Euro 645 million under the Shift Plan. In particular, SG&A expenses decreased by 13.6% compared to Q3 2013.

Alcatel-Lucent's group revenues, excluding Managed Services, were down 3.8% year-on-year to Euro 3.254 billion, and down 5.9% overall. Gross margin reached 34.0% of revenues in the quarter, progressing by 210 basis points year-on-year driven by better profitability in several business lines as well as favorable mix. Fixed costs savings amounted to Euro 73 million in Q3 2014, bringing cumulative fixed cost savings to Euro 645 million under the Shift Plan. In particular, SG&A expenses decreased by 13.6% compared to Q3 2013.

“Since the launch of The Shift Plan, our primary objective is to enable the company to generate free cash flow on a sustainable, recurring basis, starting in 2015. Our third quarter results show that we are increasingly improving our underlying profitability, an important step towards this commitment. In parallel, we have opened the second chapter of The Shift Plan, sharpening our focus on applying innovation to unlock growth in order to address our strategic ambitions within and outside of the telecoms sector,” stated Michel Combes, CEO of Alcatel-Lucent.

Some operational highlights:

Core Networking

- Core Networking segment revenues were Euro 1,443 million in Q3 2014, down 3.9% compared to Q3 2013.

- IP Routing revenues were Euro 594 million in Q3 2014, increasing 2.2%, with notable growth in Europe, APAC (outside of China) and CALA.

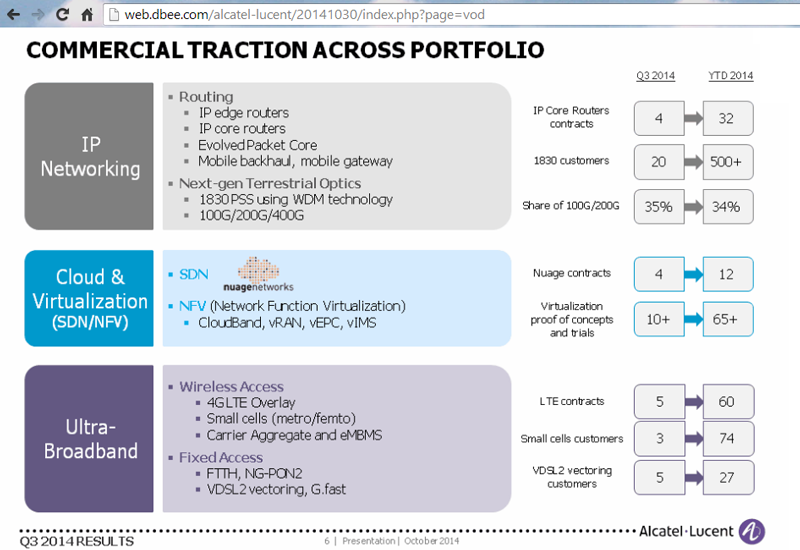

- The 7950 XRS IP Core router registered 4 new wins in Q3 for a total of 32 wins to date.

- Nuage Networks added 4 new wins in the quarter, totaling 12 customers with traction across extra-large enterprises, cloud service providers and service providers.

- IP Transport revenues reached Euro 527 million in Q3 2014, a decline of 3.3% year-on-year. Terrestrial optics increased at a high single-digit rate as the WDM portfolio continued to drive growth in EMEA and APAC.

- The 1830 Photonic Service Switch (PSS) represented 50% of terrestrial optical product revenues in the quarter, up 12 percentage points year-on-year, and now has over 500 customers.

- Year-to-date, 100G shipments represented 34% of total WDM line cards shipments compared to 26% in the same period of 2013. The 100G platform was recently selected by Telefonica Spain, MTN Nigeria and Ucom in Armenia.

Access

- Access segment revenues were Euro 1,807 million in Q3 2014, a 7.5% decrease compared to Q3 2013.

- Wireless Access revenues were Euro 1,176 million, a decrease of 1.5% year-on-year, as LTE rollouts continued at a more moderate pace in the third quarter, after accelerated investments in the first half of 2014, notably in China and North America.

- Fixed Access revenues were Euro 518 million in Q3 2014, a decrease of 4.6% from Q3 2013 as continuing demand for vectoring and fiber around the world was not enough to offset the pause in specific customer rollouts in the quarter.

- 5 new VDSL2 vectoring customers were announced during the quarter, bringing our total to 27.

Managed Services

- Managed Services revenues were Euro 97 million, decreasing by close to 50%, reflecting a strategy to terminate or restructure loss-making contracts.

http://www.alcatel-lucent.com/press/2014/alcatel-lucent-reports-q3-2014-results