Pushed lower by weakness in Europe, global service provider router and switch revenue declined 17% in 1Q13 from 4Q12, and is down 6% from the year-ago quarter (1Q12) but is expected to grow at 8.8% CAGR through 2017, according to a new report from Infonetics.

“The 1st quarter is normally down for routers and carrier Ethernet switches, so it’s better to look at the longer-term trends,” explains Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research. “The main growth drivers – the transition from TDM to packet and rising video traffic – are still in effect, the U.S. economy is slowly improving, and a number of large operators in the Euro zone intend to spend. Given these factors, we expect the router and CES market to grow at an 8.8% CAGR through 2017."

Some highlights of the report:

- North America was the only geographic region to buck the usually down Q1, posting a 7% sequential gain

- EMEA (Europe, the Middle East, and Africa), Asia Pacific, and CALA (Caribbean and Latin America) all declined by double digits in 1Q13

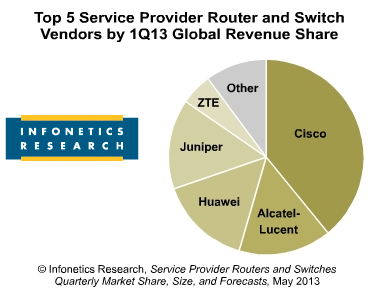

- Cisco maintains its strong hold on the #1 spot in the overall carrier router and switch market with 39% revenue share in 1Q13

- Meanwhile, the fight for the next 3 positions in the carrier router and switch market remains tight, with less than 1 percentage point separating Alcatel-Lucent, Huawei, and Juniper

- Alcatel-Lucent edged ahead of Huawei for 2nd place in 1Q13

- Private router company Compass-EOS recently announced NTT as a customer for its new core router that provides terabit-per-second connectivity to facilitate software-defined networking (SDN) and network function virtualization (NFV)