Private LTE networks have been a niche market for over a decade, with early installations like iNET's 700 MHz LTE network in the Permian Basin and Rio Tinto's network in Western Australia. However, private cellular networks based on the 3GPP-defined 5G standard are now advancing from Proof-of-Concept (PoC) trials to production-grade implementations. These standalone 5G networks are set to lay the foundation for Industry 4.0 and advanced application scenarios, offering significant improvements over LTE in terms of throughput, latency, reliability, and connection density. Despite initial challenges, early adopters are seeing tangible benefits, affirming the long-term potential of private 5G networks, according to a recently published study by SNS Telecom & IT.

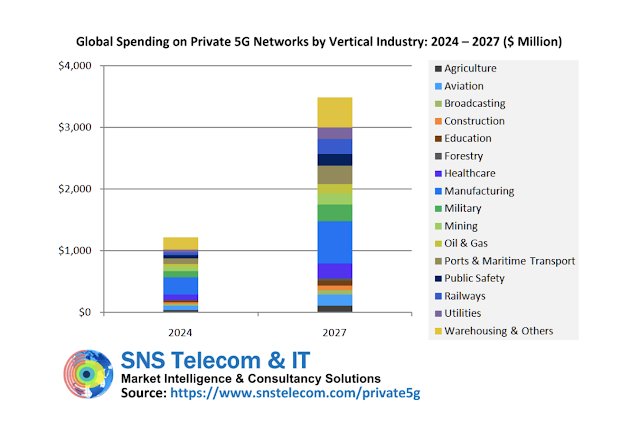

SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027.

Compared to LTE, private 5G networks can meet more demanding performance requirements. They offer capabilities like Ultra-Reliable, Low-Latency Communications (URLLC) and Massive Machine-Type Communications (mMTC), making them a viable alternative to wired connections for industrial-grade communications. Despite higher costs, 5G's wider coverage, scalability, and security features have attracted strong interest for use in Industrial IoT (IIoT) environments. China leads in this adoption, with large-scale private 5G installations supporting complex industrial operations. As digitization initiatives ramp up globally, private 5G networks are being implemented for diverse use cases, showing practical benefits in efficiency, cost savings, and worker safety.

Some Highlights

- Private LTE networks have been in use for over a decade, particularly in niche segments like mining and offshore infrastructure.

- Private 5G networks are moving beyond PoC trials to full-scale deployments, providing the foundation for Industry 4.0.

- Private 5G networks offer superior performance in terms of throughput, latency, reliability, and connection density compared to LTE.

- 5G's URLLC and mMTC capabilities support industrial-grade communications, making it a viable alternative to wired connections.

- China leads with large-scale private 5G installations, while other countries are also increasing their adoption for digitization and automation.

- Diverse Use Cases: Applications include wirelessly connected machinery, autonomous mobile robots, augmented reality, remote-controlled cranes, and digital twin models.

- Challenges: Early adopters face challenges like high costs, limited device variety, and lack of cellular wireless systems competence.

- Long-Term Potential: Despite initial challenges, early adopters are seeing tangible benefits, affirming the long-term potential of private 5G networks.

The “Private 5G Networks: 2024 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the private 5G network market, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, 16 vertical industries and five regional markets.

More info here: https://www.snstelecom.com/private5g