Citing macroeconomic pressures, inventory digestion, and a big drop in sales in North America, Nokia reported Q3 revenue of EUR 4.982 billion, down 20% from the same period a year ago.

Nokia continues to expect full year 2023 net sales in the range of EUR 23.2 to 24.6 billion with a comparable operating margin in the range of 11.5% to 13.0% assuming closure of outstanding deals in Nokia Technologies.

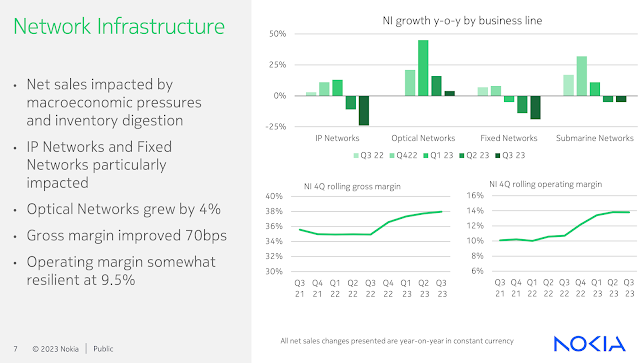

- IP Networks and Fixed Networks particularly impacted

- Optical Networks grew by 4%

- Mobile Network sales were impacted by North America continued inventory digestion; however there was strong growth in India

- Added 85 Enterprise customers in Q3

- Private wireless grew double-digit; now 675 customers

In light of results, the company announced an acceleration of its restructuring program, aiming for signicant cost savings by eliminating up to 14,000 jobs through 2026.

Pekka Lundmark, President and CEO, states:

"Our third quarter performance demonstrated resilience in our operating margin despite the impact of the weaker environment on our net sales. In the last three years we have invested heavily to strengthen our technology leadership across the business giving us a firm foundation to weather this period of market weakness.

"We continue to believe in the mid to long term attractiveness of our markets. Cloud Computing and AI revolutions will not materialize without significant investments in networks that have vastly improved capabilities. However, given the uncertain timing of the market recovery, we are now taking decisive action on three levels: strategic, operational and cost. I believe these actions will make us stronger and deliver significant value for our shareholders."

"First, we are accelerating our strategy execution by giving business groups more operational autonomy. Second, we are streamlining our operating model by embedding sales teams into the business groups and third, we are resetting our cost-base to protect profitability. We target between EUR 800 million and EUR 1 200 million in cost savings by 2026. These actions keep us on track to deliver our long-term target comparable operating margin of at least 14% by 2026."

"In the third quarter we saw an increased impact on our business from the macroeconomic challenges that are pressuring operator spending, resulting in a 15% net sales decline in constant currency compared to the prior year. Network Infrastructure declined 14% due to weaker spending impacting IP Networks while Fixed Networks was impacted by the same challenge combined with customer inventory digestion. In Mobile Networks net sales declined 19% as we saw some moderation in the pace of 5G deployment in India which meant the growth there was no longer enough to offset the slowdown in North America. Cloud and Network Services proved more robust in the quarter with a 2% decline and continued to benefit from strong growth in the Enterprise Solutions business."