Datacom optical component revenue recovered from two quarters of declines to post solid gains in Q3, led by 400GbE optical modules. Innolight and Coherent (formerly II-VI) drove growth with their expanded shipments into hyperscale applications, according to the most recent Optical Components Report from research firm Cignal AI. Lumentum remains the leading Telecom component supplier in this segment, in which overall revenue grew 6% YoY.

“400Gbps was the success story both inside and outside of the datacenter this quarter, as 400GbE datacenter optics shipments recovered from a weak Q3 and 400ZR/ZR+ drove telecom bandwidth growth for DCI applications,” said Scott Wilkinson, Lead Analyst for Optical Components at Cignal AI. “Looking forward to upcoming Q4 results and into 2023, telecom component demand will continue its recovery, while near-term growth of datacom optics will soften as inventory is absorbed.”

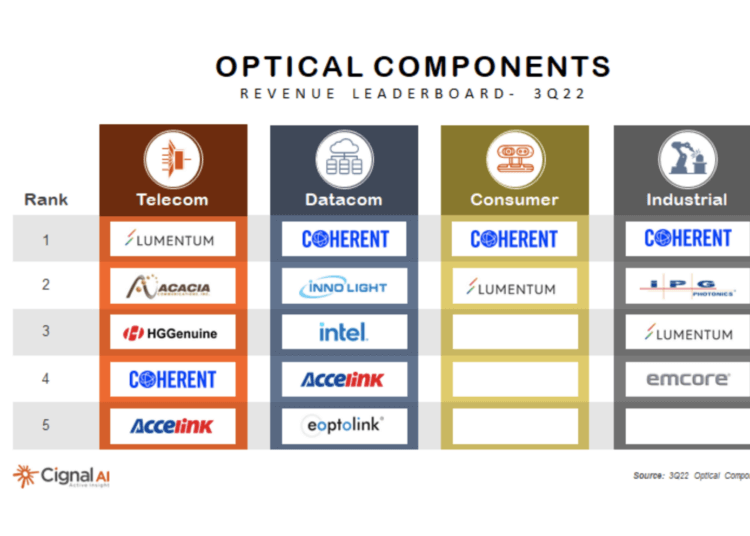

More Key Findings from the 3Q22 Optical Component Report:

- 400GbE optical module shipments returned to high growth levels this quarter and were up +50% YoY, but lower demand from hyperscale operators resulted in forecast cuts.

- After a drop due to a slowdown in orders at Amazon, 400GbE-DR returned to almost half of total 400G unit shipments in 3Q22.

- The growth of Gen60C coherent modules (400ZR/ZR+ & variants) slowed as inventory was absorbed at major customers. Specifically, CFP2 versions grew sharply as traditional telco vendors ramped sales.

- 100Gbps and 200Gbps (Gen30) coherent module shipments dropped dramatically in the quarter, mostly due to declines in sales by Chinese vendors.

- Coherent was the primary beneficiary of Consumer 3D sensing revenue gains, claiming 2/3rd of sales in the segment.