Intel announced a cost-sharing partnership in which the infrastructure affiliate of Brookfield Asset Management, one of the largest global alternative asset managers, will provide Intel with a new, expanded pool of capital for manufacturing build-outs.

Intel describes its new Semiconductor Co-Investment Program (SCIP) as a new funding model that will accelerate its IDM 2.0 foundry strategy. The partnership with Brookfield is expected to enhance Intel's balance sheet.

Under the deal, the companies will jointly invest up to $30 billion in Intel’s previously announced manufacturing expansion at its Ocotillo campus in Chandler, Arizona, with Intel funding 51% and Brookfield funding 49% of the total project cost. Intel will retain majority ownership and operating control of the two new leading-edge chip factories in Chandler, which will support long-term demand for Intel’s products and provide capacity for Intel Foundry Services (IFS) customers. The transaction with Brookfield is expected to close by the end of 2022, subject to customary closing conditions.

“This landmark arrangement is an important step forward for Intel’s Smart Capital approach and builds on the momentum from the recent passage of the CHIPS Act in the U.S.,” said David Zinsner, Intel CFO. “Semiconductor manufacturing is among the most capital-intensive industries in the world, and Intel’s bold IDM 2.0 strategy demands a unique funding approach. Our agreement with Brookfield is a first for our industry, and we expect it will allow us to increase flexibility while maintaining capacity on our balance sheet to create a more distributed and resilient supply chain.”

Sam Pollock, CEO of Brookfield Infrastructure, said, “By combining Brookfield's access to large-scale capital with Intel’s industry leadership, we are furthering the advancement of leading semiconductor production capabilities. Leveraging our partnership experience in other industries, we are pleased to come together with Intel in this important investment that will form part of the long-term digital backbone of the global economy.”

In addition, Intel confirmed that it is continuing to work with governments in the U.S. and Europe to seek incentives for domestic manufacturing capacity for semiconductors.

https://www.intc.com/news-events/press-releases/detail/1568/intel-advances-smart-capital-introduces-first-of-its-kindIntel picks Germany for its next European fab

Intel to acquire Tower Semi, expanding its foundry footprint

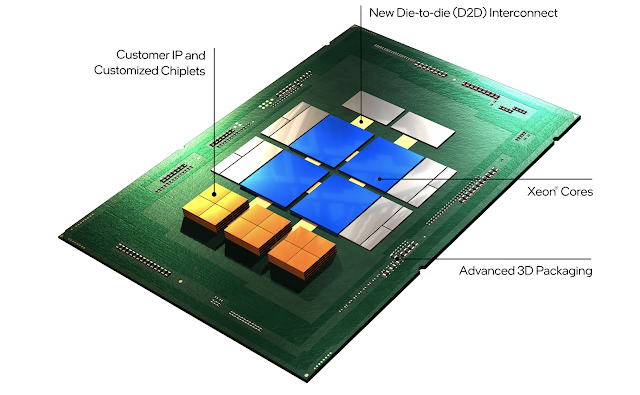

IFS makes a splash: $1B fund, Arm & RISC-V support, Open Chiplet Platform