Lumentum Holdings and NeoPhotonics announced the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 with respect to Lumentum's pending transaction with NeoPhotonics.

The consummation of the transaction remains subject to other customary closing conditions set forth in the Merger Agreement, including approval of NeoPhotonics' stockholders and approval from the State Administration for Market Regulation (SAMR) of the People's Republic of China. The transaction is expected to close in the second half of calendar year 2022, as previously announced.

Lumentum to acquire NeoPhotonics for $918M amidst strong demand

Lumentum agreed to acquire NeoPhotonics for $16.00 per share in cash, representing a total equity value of approximately $918 million and a premium of approximately 39% to NeoPhotonics' closing stock price on November 3, 2021.

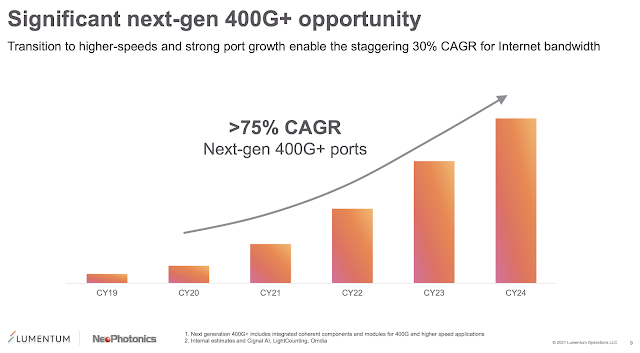

The companies cited significant next-gen 400G+ opportunities as a leading driver for the merger.

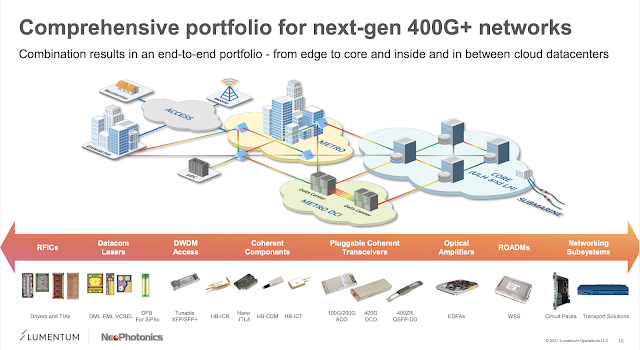

NeoPhotonics, which was founded in 1996 and is based in San Jose, is a leading supplier of tunable lasers and optoelectronic components, including devices manufactured in its own Indium Phosphide fabs and combined with electronics using using Advanced Hybrid Photonic Integration techniques. The product portfolio includes coherent components and tunable lasers, coherent transceivers, wavelength management products, as well as fixed wavelength lasers and high speed driver ICs. The company has engineering and manufacturing facilities in Silicon Valley (USA), Japan and Shenzhen, China.

Lumentum said the acquisition strengthens its position in the more than $10 billion market for optical components used in cloud and telecom network infrastructure.