A changing of the guard is underway at SES, the global satellite communications company, with a new CEO and CFO expected to take up their posts in April. The new blood comes from O3b Networks, the visionary company whose name stood for the "other 3 billion" people on the planet who lacked access to the modern communications grid and who might be reached via a next-gen satellite constellation. The initial plan was for a network of 12 High Throughput Satellites (HTS) in Medium Earth Orbit (MEO) around 8,000 kilometres from the Earth. Spotbeams from each of the satellites are capable of delivering up to 1.6 Gbps of throughput at a low latency of less than 150 milliseconds. Commercial operations began in September 2014. Early investors in O3b included SES, Google, Liberty Global, HSBC Principal Investments, Northbridge Venture Partners, Allen & Company, Development Bank of Southern Africa, Sofina, Satya Capital and Luxempart. Over time, SES increased its equity stake in the venture until eventually acquiring the whole firm in 2016. By this point, O3b's constellation was fully operational and the firm was getting recognized as the fastest growing satellite start-up.

Steve Collar, who previously was CEO of O3b has been appointed as the next President & CEO of SES, replacing Karim Michel Sabbagh who is stepping down in order to spend time with his family and to pursue new interests. Andrew Browne, who was until recently CFO of O3b Networks and CFO of SES between 2010 and 2013, has been appointed as the next CFO of SES.

Currently, four new O3b satellites have arrived safely at the Guiana Space Centre in Kourou, French Guiana, in preparation for launch by a Soyuz vehicle in March 2018. The new satellites, which will be placed into orbit at a distance of 8,000km, will augment SES’s fleet of 12 O3b satellites. As with the previous units, the new satellites were built by Thales Alenia Space. SES says a bigger constellation enables it to offer more capacity, enhanced coverage, increased efficiencies and greater reliability while delivering carrier-grade services including MEF Carrier Ethernet 2.0 certified services.

Later this week, SES is expected to release its 4Q 2107 financial results. Most of its revenue comes from long-term contracts in the satellite video distribution business, so major swings from quarter to quarter are unlikely. The company has made a much faster transition to full HD video, and now UHD 4K, than its competitor Eutelsat, although it faces the same long-term challenges as younger consumers turn to on-demand OTT video options rather than broadcast cable TV channels.

About SES

Société Européenne des Satellites (SES), which is based in Betzdorf, Luxembourg and is traded on the Euronext Paris exchange under the ticker symbol SESG, was founded in 1985 with the vision to use geostationary satellites for a pan-European TV broadcasting system.

SES currently has over 50 active GEO satellites, 12 active MEO satellites, and over 60 teleports worldwide that feed into its global terrestrial network. The combined footprint covers virtually the entire global population.

The SES business model is divided into four categories: Video, Fixed Data, Mobility, and Government services. All of these areas are growing, with Mobility being experiencing the strongest growth thanks to the installation of satellite broadband connections by many airlines worldwide.

Video remains key to SES and currently constitutes 68% of its overall sales. This has been the company's cash cow and is projected to remain so in the coming decade. SES says its distribution contracts typically run over 10 years. Current gen GEO satellites typically have 15-year lifespans. For the first nine months of 2017, SES Video generated revenue of EUR 1,031.5 billion, which was up by 1.1% over a year earlier, but down 3.3% on a like-for-like comparative basis. While revenue was sliding, at least usage was up – more households, more channels, more HD channels, more UHD. During the year, SES landed a multi-year renewal with Sky Deutschland covering seven transponders. It also signed a multi-year agreement with Viasat Ukraine to broadcast 40 pay-TV channels, including 13 HDTV channels.

Some highlights:

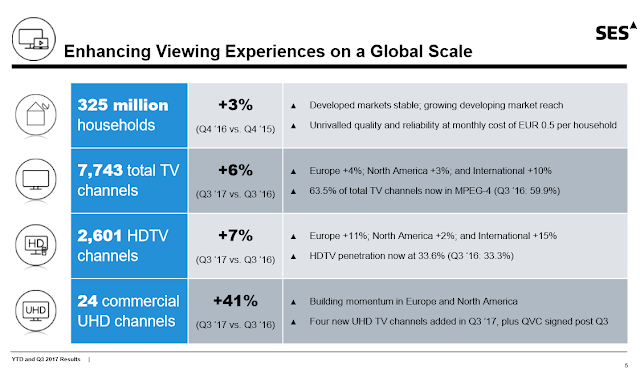

- SES estimates that its satellites are delivering video to 325 million households, up 3% YoY.

- In Europe, SES reaches 156 million households, up 2% YOY, including 30 million IPTV households

- SES is carrying 7,743 broadcast TV channels globally, up 6% YOY. Of these, 2,601 are HDTV channels, representing an HD penetration rate of 34%, up 7% YOY.

- As of November 2017, SES was also carrying its first 24 UHD channels, including Fashion One, Sky and QVC.

- SES' video feeds 44 million IPTV homes.

- SES' video feeds over 120 video-on-demand systems

- Regarding bandwidth intensive UHD, the company calculates that 30 UHD channels are bandwidth equivalent to 220 SD MPEG4 channels.

Current profile of SES Networks (includes O3b)

SES Networks appears to be the stronger side of the house, at least financially in 2017, growing 12.7%.

The company suffered a scare in June 2017 when its AMC-9 satellite experienced an anomaly on-orbit when contact and control of the spacecraft were lost for multiple days. The AMERICOM-9 (AMC-9) satellite is a hybrid C/Ku-band design based on Alcatel's Spacebus 3000B3 platform. Its C-band payload features 24 - 36 MHz transponders, while the Ku-band payload features 24 - 36 MHz transponders. During the anomaly, SES was forced to transfer all customer traffic to other satellites. AMC-9 was launched in 2003, so its operational life was coming to an end. However, the event brought some economic pain and also reminded us of the vulnerabilities of operating complex electronic systems in the hostile environment of space.

One area to highlight is the strong performance of SES’ mobility business, especially Internet access for airlines and cruise ships.

Part of this is driven by SES-15, which was launched in May 2017 and just entered commercial service in January 2018. SES-15 is the first SES hybrid satellite. It equipped with 16 Ku-band transponders (36MHz equivalent) as well as a 10 GHz high throughput payload. The all-electric satellite operates at 129 degrees West, enabling it to serve North America, Mexico, Central America and the Caribbean. One of its big customers is Gogo, which now has over 400 aircraft equipped with its 2Ku in-flight connectivity technology. Gogo’s 2Ku uses two Ku-band antennas, one for download and the other for upload. The company claims that 2Ku offers peak speeds of 70 Mbps. More impressively, Gogo has a backlog of 1,600 more aircraft awaiting the installation of its antennas. The company also says that 2KU will be compatible with future MEO satellites. Airlines that have contracted for this service include AeroMexico, Air Canada, Air Canada Rouge, Air France, Alaska Airlines, American Airlines, British Airways, Cathay Pacific, Delta, GOL, Iberia, JAL, JTA, KLM, LATAM, United, Virgin Atlantic, and Virgin Australia.

A second SES hybrid satellite is expected to come online shortly, although this one has had a bumpy ride getting there. In January 2018, an Ariane 5 rocket launched from the Guiana Space Center (CSG) suffered an anomaly during the second stage separation process. Ground tracking stations lost telemetry contact with the rocket and its two satellite payloads shortly after the second stage separation. Hours later we learned that all was well, relatively speaking. he mission carried SES-14, the second of SES' hybrid satellite to be launched. SES-14 was equipped with C-band wide beams designed for in-flight connectivity across the Atlantic. This satellite now appears to be in proper orbit, so commercial services should commence after all testing and commissioning activities are complete. SES has other in-flight connectivity partners as well, including Panasonic and Global Eagle.